Budget Live: Modi hails 'People's Budget'; Rahul says 'it will benefit only 25 people'

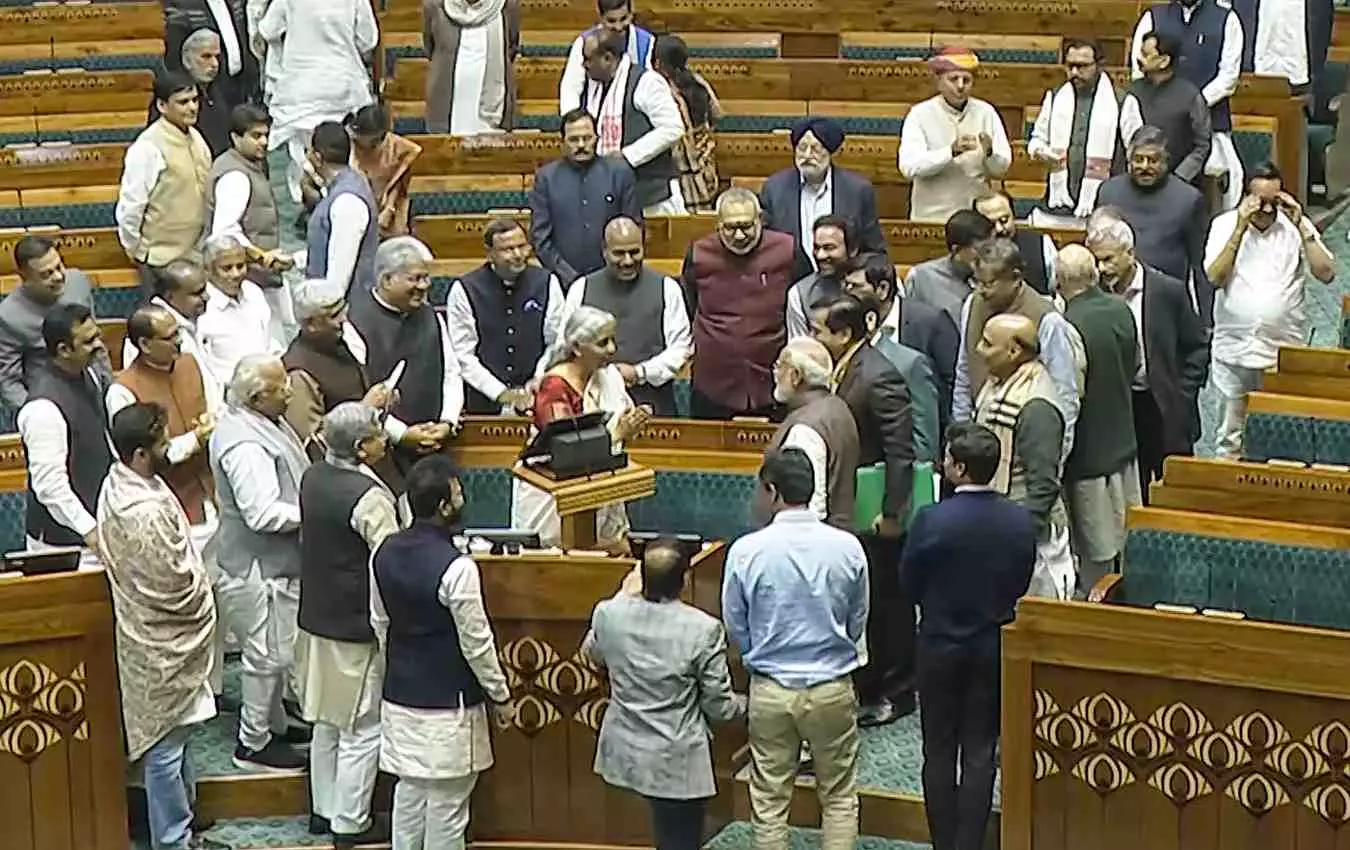

Presenting her 8th straight Budget in the Lok Sabha, Sitharaman laid out a blueprint for next-generation reforms including raising FDI limit in insurance sector, simplification of tax laws

Finance Minister Nirmala Sitharaman on Saturday (February 1) provided a big relief to the middle class as she exempted annual income of up to Rs 12 lakh from income tax and rejigged tax slabs as part of her Budget 2025-26.

Also read: Budget 2025-26: What gets costlier, what is cheaper?

Presenting her eighth straight Budget in the Lok Sabha, Sitharaman laid out a blueprint for next-generation reforms including raising FDI limit in insurance sector, simplification of tax laws, cutting duties on intermediaries while providing enhanced fiscal support for welfare measures.

Sitharaman said the government's development track record of the past 10 years and structural reforms have drawn global attention. A Viksit Bharat will have zero poverty, quality education, high-quality, affordable and comprehensive healthcare, she said and added that the Budget's focus is to take everyone together on inclusive growth path.

Also read: No income tax up to Rs 12 lakh: Know the revised slabs under new regime

Asserting that the Budget's focus is to take everyone together on an inclusive growth path, she said the proposed development measures span 10 broad areas, focusing on 'garib' (poor) youth, 'anna daata' (farmer) and 'nari' (woman), spurring agricultural growth and productivity, building rural prosperity and resilience.

Also read: Budget: Top 10 announcements: Cheer for farmers, women and gig workers

PM lauds Budget

Prime Minister Narendra Modi lauded the Union Budget as a "people's budget" that puts more money in the hands of people and said it is a force multiplier that will increase investments and lead to growth. Opposition Leader Rahul Gandhi said, ''The Budget is a band-aid for bullet wounds, and the government is bankrupt of ideas.''

Later, addressing a public rally in Sadar Bazar in poll-bound Delhi, Rahul said, "The budget was presented today, the target of the budget was to benefit 25 people. They will give you a little, they will waive a little tax but if you see the target of the budget, is to provide India's money to 20-25 billionaires.

Also Read: Interview: 'India can be the hub of GCCs and back offices

Will Budget 2025-26 ease middle-class burden? | Talking Sense with Srini

Live Updates

- 1 Feb 2025 5:30 PM IST

'Railways have been shortchanged': P Chidambaram

Congress leader P Chidambaram's statement on Budget

"There is nothing to cheer about the fact that the government has improved the fiscal deficit from the BE of 4.9 per cent to the RE of 4.8 per cent. It was achieved at a huge cost to the economy. Those who did not believe us when we said that the economy is slowing down will, I hope, believe us now. Those who did not believe us that the capacity of the government to plan and implement schemes has diminished will, I hope, believe us now.

"Capital expenditure for 2025-26 has been increased by Rs 1,02,661 crore but, having regard to the experience of 2024-25, I doubt the capacity of the government to achieve the target. I am glad, however, that the FM has shed her faith in astrologically determined numbers.

"Without burdening you with numbers, I urge you to look at the Budget Estimates and Revised Estimates for 2024-25 and the proposed Budget Estimates for 2025-26 for the following programmes/schemes. They clearly indicate that (i) the government has lost faith in these programmes announced with fanfare in the previous Budget speeches and (ii) the government’s capacity has significantly diminished. Examples are POSHAN, Jal Jeevan Mission, NSAP, PMGSY, Crop Insurance Scheme, Urea Subsidy, and PM Garib Kalyan Anna Yojana.

"The Railways have been shortchanged.... Railways serve the overwhelming majority of the population. The increase of a paltry Rs 766 crore in 2025-26 will not even account for the inflation. The allocation will be less than last year’s allocation.

"On the much-vaunted PLI schemes plus New Employment Generation Scheme plus Skill India programme that were promised to create thousands of jobs, the youth of this country have been cheated. Against a BE 2024-25 of Rs 26,018 crore, the actual expenditure will be only Rs 15,286 crore.

"Finally, it is evident that neither the FM nor the PM care for the advice of the Chief Economic Adviser. He gave sensible advice in the Economic Survey. 'Get out of the way' was his call to the government. On the contrary, the Budget is full of new schemes and programmes, many of which are beyond the capacity of this government. I counted at least 15 new schemes or programmes and 4 new Funds. The FM is walking on the worn-out path. She is not willing to break free as we did in 1991 and 2004. She is not willing to de-regulate. She is not willing to get out of the way of the people, especially the entrepreneurs and the MSMEs and the start-ups. It is the bureaucracy that will be happy with this Budget. The stranglehold of government on the activities of the people is getting tighter.

"In closing, I would like to say that the economy will trudge along on the old path and deliver no more than the usual 6 or 6.5 per cent growth in 2025-26. This is a far cry from the 8 per cent growth rate that the CEA estimated in order to become a developed country. In our view, this is a government with no new ideas and no will to reach beyond its grasp."

- 1 Feb 2025 5:25 PM IST

P Chidambaram on Budget: 'BJP wooing tax-paying middle class and Bihar electorate'

Congress leader and former Union Finance Minister P Chidambaram said, "The takeaway from Budget 2025-26 is that the BJP is wooing the tax-paying middle class and the Bihar electorate. These announcements will be welcomed by the 3.2 crore tax-paying middle class and the 7.65 crore voters of Bihar. For the rest of India, the Hononourable Finance Minister had no more than soothing words, punctuated by the applause of BJP members led by the Honourable Prime Minister."

- 1 Feb 2025 5:21 PM IST

Defence outlay pegged at Rs 6.81 lakh crore for 2025-26; 9.53% increase over current fiscal

Rs 6,81,210 crore has been set aside as defence outlay for 2025-26 over the current fiscal's allocation of Rs 6.22 lakh crore amid the military's push for modernisation in the face of security challenges from China and Pakistan.

Out of the total allocation, Rs 1,80,000 crore has been earmarked to the armed forces for capital expenditure that largely includes purchasing new weapons, aircraft, warships and other military hardware.

The defence ministry said the total defence budget of Rs 6.81 lakh crore is an increase of 9.53 per cent over the outlay made for the current financial year.

On the capital outlay, the defence ministry said Rs 1,48,722.80 crore is planned to be spent on "modernisation budget" to procure new military hardware and remaining Rs 31,277 crore is for expenditure on research and development and to create infrastructural assets.

It said Rs 1,11,544 crore that is 75 per cent of the modernisation budget has been earmarked for procurement through domestic sources. Twenty-five per cent of domestic share that is Rs 27,886 crore has been provisioned for procurement through domestic private industries.

The capital outlay for the armed forces in the next fiscal is 4.65 per cent higher than the budgetary estimate Rs 1.72 lakh crore in 2024-25. The revised capital outlay for 2024-25 has been estimated at Rs 1,59,500 crore.

The overall capital outlay has been put at Rs 1,92,387 crore out of which an amount of Rs 12,387 has been kept for defence services.

For the next fiscal, the revenue expenditure that accounts for day-to-day operating costs and salaries has been pegged at Rs Rs 4,88,822 crore that included Rs 1,60,795 crore for pensions.

The allocation for the defence budget is estimated at 1.91 per cent of the projected GDP in 2025-26.

Defence Minister Rajnath Singh welcomed the overall allocation for the defence budget saying Prime Minister Narendra Modi's vision of making India self-reliant in defence sector has got a big boost.

The capital outlay of 1,80,000 crore for defence forces will further help in the modernisation, technological advancement and capabilities of our defence forces, he said.

This budget will further strengthen the security and ensure the prosperity of the country and take a "big leap" in realising the vision of Viksit Bharat (developed India), he said.

Under capital expenditure, Rs 48,614 crore has been set aside for aircraft and aero engines while Rs 24,390 crore is allocated for the naval fleet.

An amount of Rs 63,099 crore has been set aside for other equipment.

A separate allocation of Rs 4,500 crore has been made for naval dockyard projects.

"In the current geopolitical scenario where the world is witnessing a changing paradigm of modern warfare, Indian armed forces need to be equipped with state-of-the-art weapons and have to be transformed into a technologically-advanced combat-ready force," the defence ministry said referring to the capital outlay.

In order to improve the border infrastructure and facilitate the movement of armed forces personnel through tough terrains, Rs 7,146 crore has been allocated to the Border Roads Organisation (BRO) under capital head.

The allocation is 9.74 per cent higher than the Budget estimate of 2024-25.

- 1 Feb 2025 5:18 PM IST

'Significant shift in personal taxation': NPST CEO Thakur

Deepak Chand Thakur, CEO, Network People Services Technologies Limited (NPST), praised the Union Budget for providing income tax relief to the middle class. He termed no tax obligation up to Rs 12.75 lakh as a "significant shift" in personal taxation.

"The Union Budget FY 2025-26 delivers a comprehensive framework to stimulate growth, enhance investment, and provide direct financial relief. The key highlight — no tax obligation on income up to Rs 12.75 lakh — marks a significant shift in personal taxation. By restructuring slabs and rates across the board, this measure is set to increase disposable income, fueling household consumption, savings, and investment," Thakur said in a statement.

"A direct consequence of increased discretionary spending will be a rise in digital transactions, further accelerating UPI adoption. As UPI cements its role as the dominant digital payment rail, higher transaction volumes are expected to follow," he added.

Further, sharing more thoughts on the Budget, he said, "The revamped PM SVANidhi scheme introduces enhanced micro-loans from banks, UPI-linked credit cards with a Rs 30,000 limit, and structured capacity-building initiatives. This policy shift positions UPI beyond a payment rail into a fully integrated digital credit ecosystem, bridging India’s credit gap. With an estimated 10 million street vendors gaining access to formal credit, the initiative strengthens financial inclusion while driving digital-first lending.

"The introduction of the Grameen Credit Score Framework will significantly expand rural access to credit, while streamlined KYC processes and a revamped registry by 2025 will enhance financial participation.

"The structural reforms establish a robust foundation for inclusive economic growth, ensuring that investment, digital finance, and consumer-driven expansion work in tandem."

- 1 Feb 2025 5:10 PM IST

Bihar CM Nitish: 'Budget is positive, forward-looking'

Bihar Chief Minister Nitish Kumar, in a post on his X account in Hindi, wrote, "The Union Budget is positive and welcome. This Budget of the Central government is progressive and forward-looking. Through this Budget, the Central government has taken several steps to further increase the pace of development of the country. The announcements made for Bihar in the Budget will further accelerate the development of Bihar."

He added, "The establishment of a Makhana Board in the state to improve the production, processing, value addition and marketing of Makhana will benefit Makhana farmers. Providing the facility of greenfield airports in Bihar to meet the future needs of the state will increase the number of international flights, which will greatly benefit the people here and will also accelerate the economic development of the state. The farmers here will benefit from financial assistance for the Western Kosi Canal Project in Mithilaanchal. In this budget, provision has been made for the expansion of Patna IIT, which will promote technical education. The establishment of the National Institute of Food Technology, Entrepreneurship and Management in Bihar will provide skills, entrepreneurship and employment opportunities to the youth and will promote food processing activities in eastern India.

"The middle class has got a lot of relief by getting exemption of up to Rs 12 lakh in the income tax slab. Farmers will benefit from increasing the loan limit on Kisan Credit Card from Rs 3 lakh to Rs 5 lakh. Increasing the MSME credit guarantee cover for micro enterprises from Rs 5 crore to Rs 10 crore will increase employment opportunities. Many steps have been taken in the interest of the poor, youth and farmers in the Budget, which is welcome. I thank the respected Prime Minister Shri Narendra Modi and Finance Minister Smt. Nirmala Sitharaman for presenting a better Budget."

- 1 Feb 2025 5:06 PM IST

'Reduction of personal taxation is welcome': Entrepreneur Chocko Valliappa

Entrepreneur Chocko Valliappa, who is the founder and CEO of Vee Technologies, has welcomed the government's move to reduce personal taxation, and also to set up a Centre of Excellence in AI, in the Union Budget.

"The Union Finance Minister’s announcement for setting up a Centre for Excellence in AI for the education sector deserves to be raised to create novel technologies for the rapid reskilling of manpower that may find itself out of jobs due to the integration of AI in various workplaces," Valliappa, who is also Vice Chairman of Sona College of Technology, Salem, said.

"In keeping with the FM's focus on AI and research, I believe that technical higher education institutions in the private sector demonstrating excellence in new technologies, AI, robotics and Data Sciences are granted autonomous or central university status in a fast-track mode nationwide. This will help enhance capacity building in novel technologies at a much lower cost to the nation compared to what it will cost to add the 6,500 more engineering seats in the IITs, as announced in the budget speech," he added.

On corporate taxation, Valliappa said, "While the reduction of personal taxation is welcome, corporate sector companies engaging fresh talent deserve to be taxed at a preferential rate as an incentive to invest in people-intensive sectors."

- 1 Feb 2025 4:57 PM IST

Sensex, Nifty end flat in highly volatile trade on Budget day

Benchmark indices Sensex and Nifty ended flat in a special trading session on Saturday as investors saw little coming in from the Finance Minister Nirmala Sitharaman for retail investors and the overall markets in the Union Budget.

But, buying in consumption-related sectors after Sitharaman exempted annual income of up to Rs 12 lakh from income tax and rejigged tax slabs as part of her reformist Budget prevented any major fall in the markets.

The markets were open on Saturday due to the presentation of the Union Budget.

In a day market with heavy volatility, the 30-share BSE benchmark Sensex eked out a marginal gain of 5.39 points or 0.01 per cent to settle at 77,505.96. During the day, it hit a high of 77,899.05 and a low of 77,006.47, gyrating 892.58 points.

The NSE Nifty dipped 26.25 points or 0.11 per cent to settle at 23,482.15. Intra-day, the benchmark scaled a high of 23,632.45 and a low of 23,318.30.

Markets were rallying for the past four days.