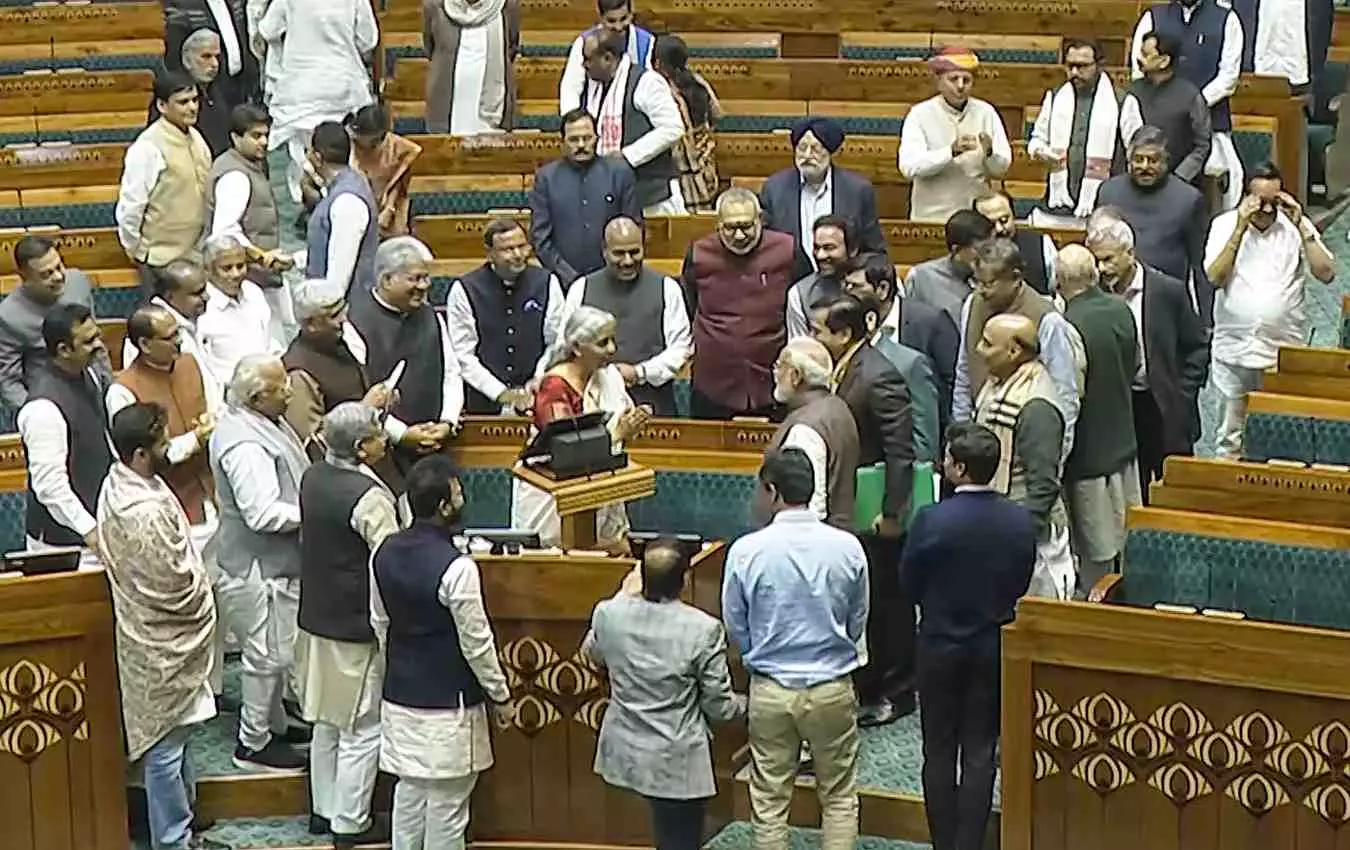

Budget Live: Modi hails 'People's Budget'; Rahul says 'it will benefit only 25 people'

Presenting her 8th straight Budget in the Lok Sabha, Sitharaman laid out a blueprint for next-generation reforms including raising FDI limit in insurance sector, simplification of tax laws

Finance Minister Nirmala Sitharaman on Saturday (February 1) provided a big relief to the middle class as she exempted annual income of up to Rs 12 lakh from income tax and rejigged tax slabs as part of her Budget 2025-26.

Also read: Budget 2025-26: What gets costlier, what is cheaper?

Presenting her eighth straight Budget in the Lok Sabha, Sitharaman laid out a blueprint for next-generation reforms including raising FDI limit in insurance sector, simplification of tax laws, cutting duties on intermediaries while providing enhanced fiscal support for welfare measures.

Sitharaman said the government's development track record of the past 10 years and structural reforms have drawn global attention. A Viksit Bharat will have zero poverty, quality education, high-quality, affordable and comprehensive healthcare, she said and added that the Budget's focus is to take everyone together on inclusive growth path.

Also read: No income tax up to Rs 12 lakh: Know the revised slabs under new regime

Asserting that the Budget's focus is to take everyone together on an inclusive growth path, she said the proposed development measures span 10 broad areas, focusing on 'garib' (poor) youth, 'anna daata' (farmer) and 'nari' (woman), spurring agricultural growth and productivity, building rural prosperity and resilience.

Also read: Budget: Top 10 announcements: Cheer for farmers, women and gig workers

PM lauds Budget

Prime Minister Narendra Modi lauded the Union Budget as a "people's budget" that puts more money in the hands of people and said it is a force multiplier that will increase investments and lead to growth. Opposition Leader Rahul Gandhi said, ''The Budget is a band-aid for bullet wounds, and the government is bankrupt of ideas.''

Later, addressing a public rally in Sadar Bazar in poll-bound Delhi, Rahul said, "The budget was presented today, the target of the budget was to benefit 25 people. They will give you a little, they will waive a little tax but if you see the target of the budget, is to provide India's money to 20-25 billionaires.

Also Read: Interview: 'India can be the hub of GCCs and back offices

Will Budget 2025-26 ease middle-class burden? | Talking Sense with Srini

Live Updates

- 1 Feb 2025 1:22 PM IST

Key Highlights of Budget 2025-26

Economic Vision and Growth Strategy

The Budget is built on the theme of "Viksit Bharat", with a focus on Garib (poor), Yuva (youth), Annadata (farmers), and Nari (women).

The economy is projected to be the fastest-growing major economy globally.

A roadmap has been laid out for balanced regional growth and inclusive development.

Major Expenditure and Fiscal Indicators

Total Expenditure: Rs 50.65 lakh crore.

Capital Expenditure: Rs 11.21 lakh crore, reflecting the government’s emphasis on infrastructure.

Fiscal Deficit: Targeted at 4.4% of GDP, showing continued fiscal consolidation.

Investment in Key Sectors

Agriculture & Rural Development

Prime Minister Dhan-Dhaanya Krishi Yojana: Focus on 100 low-productivity districts to enhance output and credit availability.

Mission for Aatmanirbharta in Pulses: Special emphasis on self-sufficiency in pulses like Tur, Urad, and Masoor.

Makhana Board in Bihar: To improve production, processing, and marketing of Makhana.

Jal Jeevan Mission: Extended till 2028 for full coverage.

MSMEs & Manufacturing

Special focus on MSMEs as the second engine of growth.

Expansion of Mudra Loans and credit guarantee schemes for small businesses.

Launch of E-Commerce Export Hubs to promote Indian small businesses globally.

Infrastructure & Energy

Rs 1.5 lakh crore allocated as interest-free loans to states for infrastructure projects.

A new Asset Monetization Plan (2025-30) worth Rs 10 lakh crore.

Expansion of Green Energy & Clean Tech manufacturing, including solar PV, wind turbines, and grid-scale batteries.

Education & Skilling

50,000 Atal Tinkering Labs to be set up in government schools.

Expansion of IITs with additional infrastructure.

National Centres of Excellence in AI for education.

PM Internship Scheme to support youth employment.

Healthcare & Social Security

10,000 additional medical seats in 2025-26 towards a target of 75,000 new seats in five years.

Day Care Cancer Centres in all district hospitals.

Social Security Scheme for Gig Workers, including health coverage under PM Jan Arogya Yojana.

Taxation & Fiscal Policy

Simplification of tax laws, including amendments to corporate taxation of direct tax slabs for middle-income groups.

GST reforms and enhanced revenue collection.

Urban Development & Connectivity d of Rs 1 lakh crore to improve cities as growth hubs

Modified UDAN Scheme to connect 120 new destinations

Western Koshi Canal Project in Bihar

Tourism & Culture

Top 50 tourism sites to be developed with state partnerships

SWAMIH Fund 2.0 worth Rs 15,000 crore housing projects

Medical Tourism & "Heal in India"

Conclusion

The Budget's focus on agriculture, MSMEs, clean energy, health, and skilling aligns with the long-term goal of making India a $5 trillion economy while ensuring social security and equitable progress.