All eyes on Strait of Hormuz, but India needs to watch its oil vulnerability

While the Israel-Iran conflict may be outside its purview, India can and should address its rising oil import dependency and falling domestic oil production

How will the Israel-Iran conflict impact India’s oil economy? The assessments vary but one thing is common to all: crude oil prices have gone up and are likely to remain elevated.

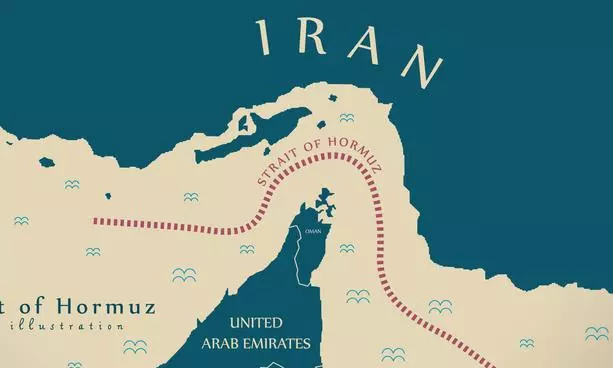

This is not only because oil supply from Iran will be impacted but also because oil supply is carried out through the Strait of Hormuz, which Iran may shut down. The strait accounts for 20 per cent of global crude oil movement (average of 20 million barrels per day). Located between Oman and Iran, it is one of the world’s most important oil chokepoints.

Also read: Are Netanyahu's two war aims to destroy Iran's nuclear plan and regime change achievable?

The impact of the Israel-Iran conflict is already visible. The Ministry of Petroleum and Natural Gas’s Petroleum Planning & Analysis Cell (PPAC) data shows that the price of India's crude oil basket went up sharply to $73.06 per barrel on June 16, from $64 in May, after the conflict broke out. This despite India importing very little oil from Iran.

Trade disruption

Following fresh US sanctions on Iran, with US President Donald Trump scrapping the nuclear deal with it in 2018, India's import of Iranian oil fell to $1.06 billion in 2024. It would have gone down further after the US sanctioned four Indian companies in February for involvement in trade with Iranian oil.

The immediate threat is from trade disruption through the Strait of Hormuz in case Iran shuts it down, and/or if a full-fledged war breaks out between Iran and Israel, with the US backing the latter.

Brent price jumped from around $70 per barrel to over $76 after Israel began its strike on Iran on June 13. It moderated since then to $74.6 on June 19, as Iran’s oil facilities were found unaffected. In the worst-case scenario, Brent prices may go up to $120 per barrel.

Also read: Israel’s attacks on Iran are hurting global oil prices, impact is set to worsen

But this is an external factor over which India has little control.

What India should really be concerned about is twin developments that it could control but hasn’t:

a) oil import dependency has risen sharply

b) domestic oil production has fallen drastically in recent years

Oil import dependency

Very few know that in its latest monthly report of April, the PPAC made a shocking revelation: India’s crude oil imports went up to 90.2 per cent of its consumption (212.3 million tonnes of imported oil against domestic production of 21.2 million tonnes) in April. This is a rise from 89.4 per cent in FY25.

Also read: Iran-Israel conflict: Decoding Trump's game plan and India's stance? | Discussion

This rise in import dependency is far worse than it appears at first glance.

Go back to March 27, 2015. Inaugurating Urja Sangam 2015 at Vigyan Bhavan, New Delhi, Prime Minister Narendra Modi set the goal of reducing oil import dependency from 77.6 in FY14 to 67 per cent by 2022, to coincide with India’s celebration of 75 years of Independence.

But, in February 2021, when retail petrol prices touched Rs 100 per litre and oil import dependency went up to 87.6 per cent , Modi blamed previous governments for the situation instead of explaining his government’s failure or renewing the commitment. In FY25, this dependency went further up to 90.2 per cent (from 77.6 per cent in FY14), a rise of 15.2 per cent.

But the bigger shock is on the domestic production front.

Domestic production

The Ministry of Power’s December 2024 report, India Energy Scenario for the Year 2023-24, said domestic crude oil production declined "at the annual rate of 3 per cent” between FY17 and FY24, from 36 million tonne to 29 million tonne.

Going by the domestic crude oil production of 37.8 million tonne in FY14 (PPAC 2014 and 2015 ) and 28.7 million tonne in FY25 (PPAC 2025 ), this is a sharper fall of 24.1 per cent. The production fall contrasts with a 13.2 per cent rise in crude oil imports.

The following graph maps these changes.

Of the total domestic production, Oil and Natural Gas Corporation Ltd (ONGC) and Oil India Ltd (OIL) accounted for 72.7 per cent of the total crude in FY25 and 75 per cent in April 2025. The rest came from contractual ventures.

Why this fall in oil production?

Shockingly, the Ministry of Power’s 2024 report (stating 3 per cent annual decline between FY17 and FY24) didn’t devote much space to explaining why domestic oil production fell rapidly.

It merely listed three factors in parentheses: "This decline in production can be attributed to several factors, including the natural depletion of older and marginal fields, accessibility and technical challenges in certain reservoirs, disruptions in field activities, etc.”

At the same time, it went on to list the Centre’s initiatives to boost domestic production and reduce oil import dependency in detail.

Also read | Exporters brace for freight, insurance surge as Israel-Iran conflict worsens

About the initiatives to boost domestic production, it said: “These initiatives include reforms in the Hydrocarbon Exploration and Licensing Policy (HELP) 2019, Policy Framework for Exploration and Exploitation of Unconventional Hydrocarbons 2018, induction of suitable technologies on selective fields, monetisation of small and marginal discoveries in onshore through service contract and outsourcing”.

As for the steps to reduce oil import, it said: “The Government of India has taken a few measures to reduce the country’s dependency on oil import. The measures such as the electrification of the transport sector, ethanol blending in petrol, Sustainable Aviation Fuel (SAF) in the aviation sector and the production of compressed biogas offer potential avenues to mitigate India’s reliance on imported crude oil.”

No course correction

Quite clearly, none of the set of initiatives has worked. Rather, the reverse has happened on both fronts.

But the report didn’t explain why both sets of initiatives failed. Scanning annual reports and other reports of the ministries concerned doesn't provide any clue. This means no course correction can be expected.

Meanwhile, in January, Fitch Ratings was quoted as saying India’s domestic crude oil production was expected to fall by 2-3 per cent in FY25, attributing it to “the ongoing struggle of companies like ONGC to arrest the natural output decline at mature fields through technology investments to raise recovery and tap isolated reservoirs”.

Sure, India needs a detailed study to identify the real issues and the political will to set things right.

Renewable energy conundrum

India has made rapid progress in renewable energy (RE). But two caveats are in order here.

One, the latest analysis by Climate Action Tracker (May 16, 2025 ) says that though India’s total RE generation capacity has risen to 37 per cent of the total, it contributes only 18 per cent to the actual power mix.

The other caveat is: 40 GW of RE energy projects – completed or under construction – has failed to find buyers, and hence, is idle. Apart from the high cost, the lack of evacuation facility (transmission and distribution) is a major constraint. Such is the situation that leading RE firms were seeking buyers for their 20 GW projects late last year.

Coming back to India’s twin-problem (rising import dependency and falling domestic production of crude oil), several disturbing trends have emerged in recent years that need course corrections.

Oil PSUs as cash cows

The focus seems more on milking the petroleum sector for the exchequer, primarily by the Centre. The sector remains outside GST (introduced in 2017), and it attracts a wide variety of taxes: cess, royalty, customs, excise, IGST, CGST, SGST, UTGST, dividend/direct tax and others.

During FY15-FY25, the Centre collected Rs 38.8 lakh-crore and states another Rs 25.4 lakh-crore, taking the total to Rs 64.2 lakh-crore. Of this, the Centre received dividend/direct tax of Rs 1.28 lakh-crore and states Rs 2,164 crore, taking the total to Rs 1.3 lakh-crore.

The Centre has also milked oil PSUs for the PMCARES Fund (per RTI replies), building statues, renovating temples and temple corridors (per CAG report). The fall in the sector’s contribution to the exchequer in FY25 is mainly attributed to the cut and then scrapping of the windfall tax.

But why should this be flagged?

Tax burden on citizens

The retail prices of petrol (as also diesel and LPG) remain elevated since FY15, despite crude prices crashing from an average of $108.5 per barrel during FY12-FY14 to $58.5 during FY15-FY21, before the Russia-Ukraine war hit (February 2022).

Even then, the prices never touched $100 (peak of $93.2 in FY23) and fell to $78.6 in FY25. This was because India sourced enough cheap Russian oil.

Like the drastic fall in crude prices, the Russian cheap oil brought no relief to ordinary citizens (retail prices remain elevated). Instead, it generated windfall gains for oil marketing companies, particularly private ones who exported (after refining) to the EU, making India the biggest supplier to the European bloc.

The Centre did impose a windfall tax on oil companies (thereby, pumping up its own kitty), then reduced and finally scrapped it in December 2024 – but ordinary citizens got no relief.

To sum up, the Israel-Iran conflict may escalate or de-escalate, but India needs to treat the oil and energy sector with the seriousness it deserves to reduce its vulnerability, both in terms of forex outgo and price volatility.