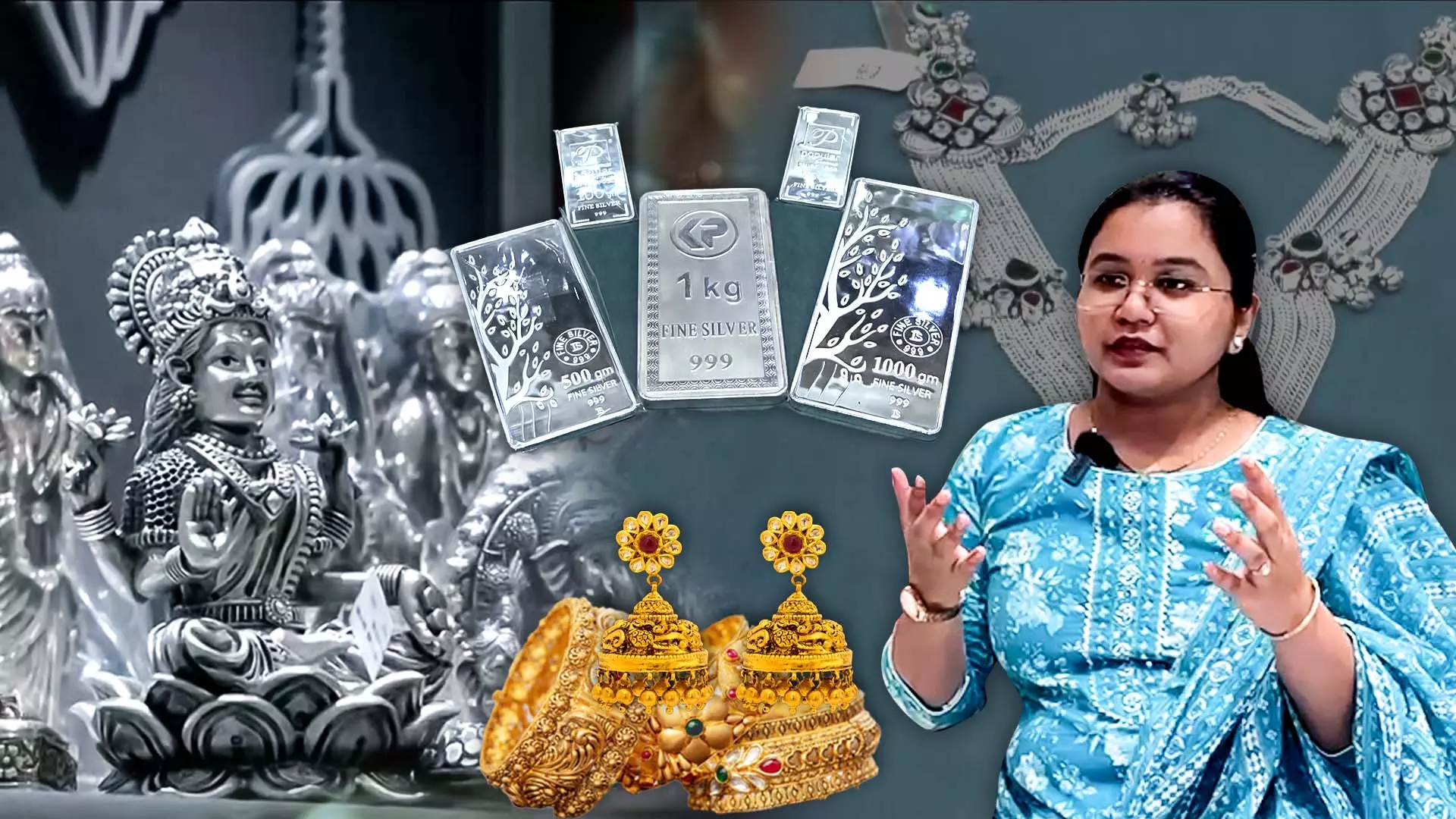

Investors turn to silver bars as gold becomes costly

Record gold rates this Deepavali are reshaping buying patterns, with silver emerging as a strong investment choice for consumers

The Federal spoke to S. Abhinaya, a gold and silver retailer, about how record-high prices this Deepavali are influencing consumer behaviour and how jewellers are adapting to the changing market.

Abhinaya explains that the festive season, spanning Diwali, Navratri, and other regional festivals, usually sees high circulation of money due to bonuses and salary hikes. “This year, the price increase is not demand-driven but a result of global market dynamics. We’ve observed a 15 to 20% drop in customer footfall, and while people are still buying, the average order value has decreased.”

Also read: Are silver ETFs the next big thing for Indian investors?

Silver has seen unprecedented growth, with rates jumping around 100 per cent from 2024 to 2025.

Abhinaya said, “Unlike gold, silver has high industrial demand. With its investment potential recognised by consumers, demand has surged. Many stores are out of stock, but we’ve managed to maintain enough inventory for our customers, especially with Diwali approaching.”

“People are increasingly buying silver coins and bars for investment. Gold-plated silver jewellery is also gaining popularity for festive and wedding occasions. This allows consumers to own more within their budgets,” Abhinaya noted.

Also read: Gold hits an all-time high of Rs 1,28,395 per 10 grams; silver also surges

Abhinaya highlights the trend toward lower-carat jewellery and lightweight designs: “With rising rates, customers are asking about 9-karat and 10-karat options. We are launching lighter collections and innovative designs to keep jewellery affordable. For example, what we used to make with 100 grams of bullion now requires 80 grams due to higher prices, so innovation is key.”

When asked whether she expects the silver surge to continue after Deepavali, she said, “Yes, in the long term, silver is expected to rise, potentially reaching Rs 250–500 per gram over 5–10 years. There will be short-term corrections of 20–30 per cent, but overall the trend is upward. Consumers and jewellers alike are preparing for sustained demand.”

Abhinaya’s insights show that while festive buying is influenced by cultural factors, global market dynamics and investment trends are reshaping the jewellery industry. Lightweight designs, silver bars, and lower-carat options are becoming the norm as consumers adapt to higher prices.

(The content above has been transcribed from video using a fine-tuned AI model. To ensure accuracy, quality, and editorial integrity, we employ a Human-In-The-Loop (HITL) process. While AI assists in creating the initial draft, our experienced editorial team carefully reviews, edits, and refines the content before publication. At The Federal, we combine the efficiency of AI with the expertise of human editors to deliver reliable and insightful journalism.)