India–EU FTA decoded: Trade expert Biswajit Dhar on winners, losers, and hidden risks

As India and the EU seal a landmark free trade pact, sweeping tariff cuts collide with tough regulations, farm exclusions, and geopolitical pressures. Trade economist Biswajit Dhar explains who gains —and who could face the heat

India and the European Union have concluded a long-pending Free Trade Agreement, projected as a landmark moment in India’s global trade strategy. While the deal promises sweeping tariff eliminations and access to a high-income market, it also raises questions about regulatory barriers, agriculture, MSMEs, and geopolitical recalibrations. Trade economist Biswajit Dhar explains what the agreement actually delivers — and where the risks lie.

What is immediately clear is that the EU gains access to one of the world’s most lucrative consumer markets. What does India get from this deal?

India also gains access to a large and relatively affluent market. According to the Commerce Ministry, tariffs on nearly 99 per cent of Indian exports to the European Union will be eliminated once the agreement is implemented. This will not happen overnight—the implementation is expected sometime next year.

That is the broad framework. Several labour-intensive sectors, especially textiles and clothing, are expected to benefit significantly from improved access to the EU market.

Which Indian sectors are likely to benefit the most, and which ones could face pressure?

Most sectors that already export to the European Union stand to gain. These include iron and steel, pharmaceuticals, textiles, and clothing. Beyond these, newer export sectors that have emerged in recent years—such as mobile phones and other electronic products—are also likely to see growth in exports over time.

There is little doubt that the deal was expedited due to pressures both India and the EU have faced from US trade policies, including tariffs and broader uncertainty under the Trump administration.

At the same time, agriculture and dairy have been kept out of the agreement. This has been a sensitive issue not only in India–EU trade negotiations but also in India’s trade discussions with other partners.

Also Read: India-EU FTA: Good beginning, but don’t count the chickens yet

India has taken a cautious approach by excluding core agriculture and dairy. Is that justified in a deal described as historic?

India cannot afford to open up its core agricultural sectors. The country has a very large number of small and marginal farmers who are unable to withstand import competition. Opening these sectors would pose serious risks to food security and rural livelihoods.

This has been a consistent policy stance for decades, beginning with India’s approach at the World Trade Organization. Whenever India enters trade agreements, it has made it clear that the core of Indian agriculture will not be exposed to import competition.

Manufacturing sectors, on the other hand, are treated differently. Even within agriculture-linked industries, food processing has been opened up—something the European Union is keen on. It is primarily cereals and dairy products that remain excluded.

Overall, this reflects a calibrated integration strategy—opening sectors where India can compete, while protecting those where livelihoods are at stake.

The EU is known for strict regulations. Do sustainability, carbon, and labour clauses enhance competitiveness or act as non-tariff barriers?

There is no doubt that this presents a major challenge. Lowering tariffs alone will not automatically lead to higher exports.

The European Union relies extensively on regulatory standards. These include environmental norms, labour standards, and mechanisms such as the Carbon Border Adjustment Mechanism, which is already in place for five sectors and is expected to expand further. Compliance with these standards will impose significant costs on Indian industry and will not be easy.

Labour standards pose another challenge. India will be expected to align with International Labour Organization norms. Historically, and even recently through the new labour codes, India has favoured a more flexible labour regime that does not fully align with international benchmarks.

European stakeholders are extremely particular about sustainability commitments. The agreement will include institutional mechanisms to monitor compliance, and partner countries will be expected to fully implement the commitments they sign on to.

You have flagged intellectual property, particularly plant varieties, as a potential flashpoint. Why?

The European Union has stated that India has agreed to provide a high level of intellectual property protection, including for plant varieties. This is a serious concern.

India follows a sui generis system for plant variety protection that recognises farmers’ rights and their contribution to plant breeding. This system allows farmers to save, reuse, and exchange seeds.

The international system favoured by the EU — the International Convention for the Protection of New Varieties of Plants — is far more restrictive. It does not allow seed reuse and does not recognise farmers’ rights.

This could become a major area of contention. This assessment is based on initial readings, and the final impact will depend on the exact wording of the agreement. There are also other sensitive areas, including how government support to MSMEs is treated under the competition policy chapter, where the EU tends to insist that its own norms be followed by partner countries.

Many of the sectors expected to gain—textiles, gems and jewellery—are MSME-driven. Will EU compliance norms favour large corporations over small firms?

India needs to meet international standards if it wants access to developed-country markets. These markets have strict health, safety, environmental, and labour requirements. There is no alternative to meeting these standards.

Historically, India’s exports have lagged because both government and industry have focused too narrowly on tariff barriers, while neglecting non-tariff measures. Compliance has not been taken seriously enough.

This agreement presents both an incentive and a challenge. If India wants to benefit from market access, it must be prepared to meet compliance requirements.

Past free trade agreements have not worked well for India because partner countries exploited Indian markets while India failed to fully utilise the access it received. A key reason for this has been India’s inability to meet compliance standards in partner countries.

The stakes are much higher with the EU. India also needs to diversify exports away from the United States due to policy uncertainty. This agreement can work in India’s favour—provided compliance issues are addressed head-on.

Could increased imports from Europe reduce India’s dependence on China?

No. India imports a large volume of intermediate goods from China, and that is unlikely to change because imports from the EU will largely be finished products.

However, if India succeeds in increasing exports, intermediate imports from China could be used more productively. The central issue is not import substitution but export growth.

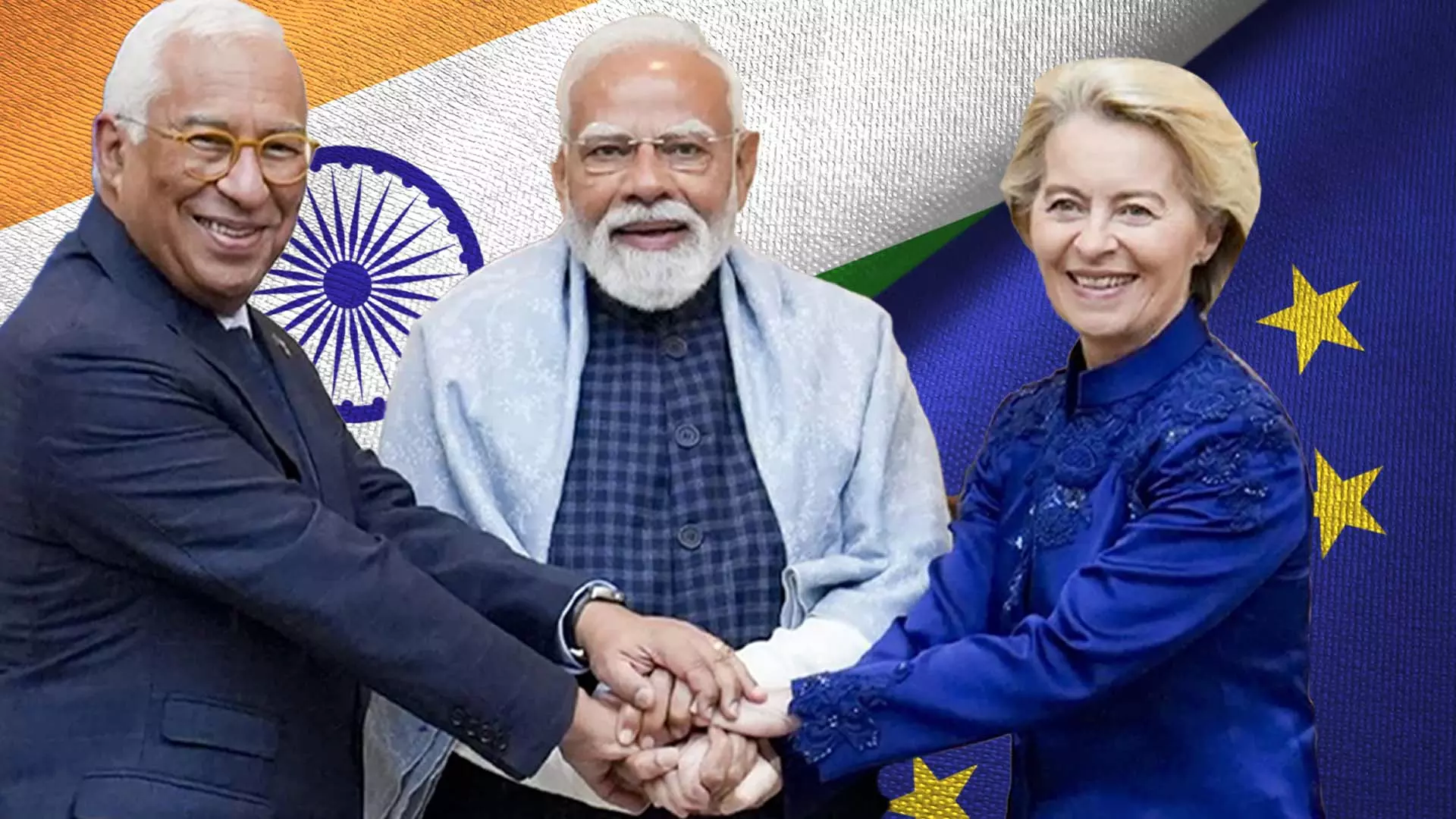

The visible camaraderie between Prime Minister Narendra Modi and European Commission President Ursula von der Leyen stood out. Was US pressure a factor in expediting this deal?

There is little doubt that the deal was expedited due to pressures both India and the EU have faced from US trade policies, including tariffs and broader uncertainty under the Trump administration.

That said, this relationship should go beyond bilateral trade. India and the EU need to work together at the global level to repair the multilateral trading system.

This agreement provides an opportunity for India and the EU to collaborate with like-minded countries and begin repairing some of the damage to global trade governance.

Could this agreement put pressure on the United States to conclude a trade deal with India?

I do not think so. Donald Trump has been very clear about his demands, particularly opening up India’s cereals market—wheat, rice, corn, and soyabean. That remains a strict no for India.

Opening these markets would violate political commitments made to farmers and create serious uncertainty at a time when farmers are already under stress. For an India–US deal to move forward, the US would need to significantly soften its position, which appears unlikely in the near future.

The content above has been transcribed from video using a fine-tuned AI model. To ensure accuracy, quality, and editorial integrity, we employ a Human-In-The-Loop (HITL) process. While AI assists in creating the initial draft, our experienced editorial team carefully reviews, edits, and refines the content before publication. At The Federal, we combine the efficiency of AI with the expertise of human editors to deliver reliable and insightful journalism.