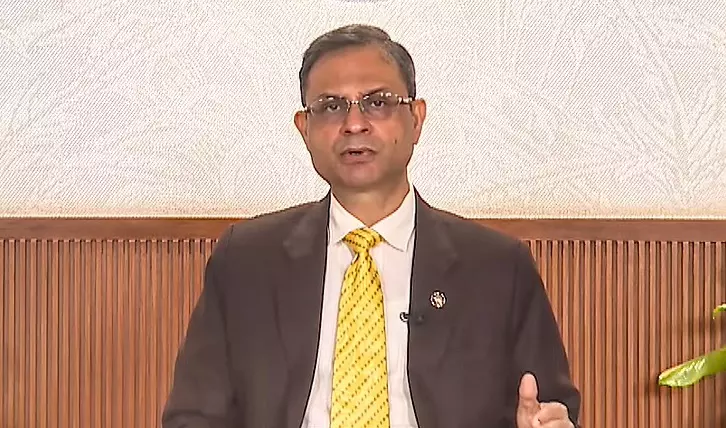

RBI moving with caution, but need for courage led to easing of bank norms: Governor

RBI Governor Sanjay Malhotra said the central bank will reform with courage but caution, easing norms for banks while safeguarding financial stability

Governor Sanjay Malhotra on Friday (November 7) made it clear that the Reserve Bank would continue to move with "caution", but the need to "display courage" has led to the easing of norms governing banks' activities recently.

Speaking at an event organised by SBI, Malhotra said that the higher responsibilities placed on banks were a result of better performance and improved governance, and added that the central bank possesses sufficient tools to rein in any errant behaviour.

Also Read: Musk set to become world's first trillionaire as Tesla approves pay package

He also said that the RBI does not wish to micromanage, adding that no regulator can or should substitute for boardroom judgment, and each case has to be looked at with merit by a regulated entity.

Raft of measures

Last month, the RBI announced a raft of measures and intentions, including those on allowing banks to fund domestic acquisitions and foreign borrowings for the real estate sector, among others.

Since assuming office, Malhotra has stressed making it easier to do business and also considering the cost of regulations before announcing any move.

"...while we move with caution, we need to display courage," Malhotra said, explaining the rationale behind the moves.

Also Read: OpenAI faces 7 lawsuits in US alleging ChatGPT drove people to suicide, harmful delusions

Compromising financial stability while chasing short-term growth could extract costs through long-term impact on growth, Malhotra said, adding that the central bank also needs to be conscious of the economic context and play a balancing act.

"Economic interest warrants increasing efficiency and promoting innovation, which is also the duty of the RBI. We recognise that just like there are no free lunches, regulation to enhance stability too is not devoid of costs," he said.

The changes introduced were incremental in nature and did not represent a sea change in the norms governing banks, Malhotra said.

"All these measures are balanced and appropriate, built on the bedrock of a banking system that has been systematically fortified over the last decade, with financial stability remaining the unwavering cornerstone of a policy architecture," he added.

'Go wisely and slow'

Quoting from Shakespeare's classic play Romeo and Juliet, the RBI governor hinted that the central bank would "go wisely and slow", as running fast might lead to stumbles. Flagging risks, Malhotra further said dangers were inherent in life and exist even in mundane activities.

The role of a regulator is akin to that of a gardener, Malhotra said, describing that a central bank also monitors the growth of a plant and prunes unwanted growth to "shape a collective, orderly, beautiful garden".

Also Read: Rs 100 cr housing fraud in Mumbai; case filed against builder, others

He added that the RBI has enough tools like changing the risk weights, tinkering the provision norms and put counter-cyclical buffers to contain any emerging risks, and the regulator displayed the same in November 2023 when it increased the risk weights on unsecured lending.

Additionally, the RBI could also deploy supervisory actions to moderate or prune unsustainable growth, he said, stressing that much of the work had led to draft norms and the same would be finalised after considering all the feedback.

Easing of financing norms

About easing of financing norms for banks, Malhotra said the acquisition finance move would benefit the real economy once implemented. He said there would be guardrails like limiting bank funding to 70 per cent of deal value.

The liberalisation moves on external commercial borrowing came amid strengthening the external sector and strong inflows, the governor said, calling it a "natural step" in India's financial evolution.

Also Read: Hyderabad, Bengaluru lead in GCC leadership roles: Report

He added that the RBI's projections show that the capital flows will remain "quite strong" even during the remainder of the fiscal year.

Clarifying the move to allow real estate companies to borrow from abroad, Malhotra said the ECB is permitted only for projects compliant with foreign direct investment (FDI) norms, and will remain prohibited for any speculative activity or land buys.

The RBI is trying to make rule-making more open, more driven by data and evidence, after public consultation and the assessment of the impact of the move, he said.