Is RBI being overly optimistic in projecting 6.8 pc growth for FY26?

RBI revises growth projection by seemingly underestimating the impact of 50 pc US tariffs, overestimating gains from GST rate cut, and above normal monsoon

The Reserve Bank of India (RBI) may be too optimistic in raising its growth estimates for FY26 to 6.8 per cent, from its own estimate of 6.5 per cent at the previous round of the monetary policy committee (MPC) meeting in August.

At that time, the RBI had kept the growth projection steady at 6.5 per cent, despite the looming tariff threats from the US. It does so now, too, despite the US having carried out its threats and adding a few more barriers. The RBI is doing so by relying on a few positive indications on the domestic front to claim that the risks are “evenly balanced”. But it misses the point that the outcomes of the domestic developments will be known months later, while the impact of the US tariffs is visible.

Also read: UPI transactions to remain free, says RBI Guv Sanjay Malhotra

External threat to growth

Since the August round of the MPC, the US has imposed an additional 25 per cent (penalty) tariff on Indian goods for India’s import of Russian crude, taking the total to 50 per cent, the highest against any country, along with Brazil. This has disrupted 55 per cent of $87.3 billion of goods exports to the US. The US market is important for another reason – it generates the maximum surplus in goods trade.

The US has also raised the H-1B visa fee to $100,000 – from earlier $2,000-5,000 – for all new applicants. Since Indians received 72 per cent of the visa during October 2022-September 2023, this will disproportionately impact India and disrupt remittances. Remittances from the US accounted for 27.7 per cent of total remittances in FY24 (according to the RBI bulletin of March 2025). The US has also imposed a 100 per cent tariff on branded drugs, which may not matter much since India mostly exports generic drugs. It, however, will add to the negative sentiments in the domestic market.

Also read: RBI keeps repo rate unchanged at 5.5% for second consecutive time

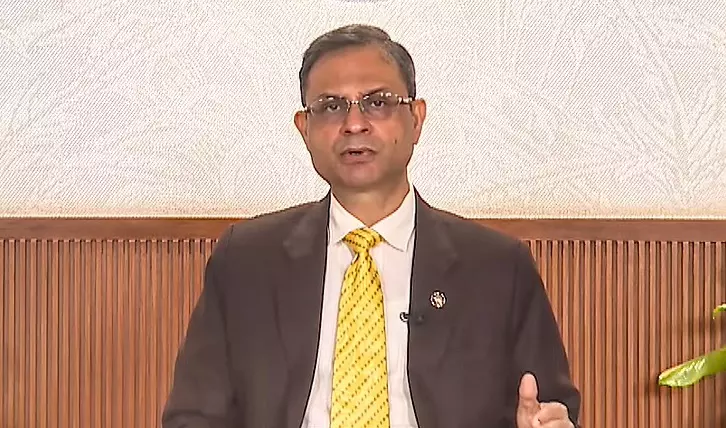

RBI Governor Sanjay Malhotra acknowledged the external threats to growth by stating that “global uncertainties and tariff-related developments are likely to decelerate growth in H2:2025-26 and beyond,” but went on to dismiss it by adding that the risks are “evenly balanced,” which may not be true and would be clear soon.

Domestic signs not as robust as RBI thinks

The RBI governor’s optimism emanates from several domestic factors: “above normal monsoon, good progress of kharif sowing and adequate reservoir levels” (which are expected to raise agriculture output and rural demand), “buoyancy in services sector coupled with steady employment conditions” (supporting demand), GST rate cuts, rising capacity utilisation, healthy financial system and “robust services exports coupled with strong remittance receipts” etc.

But the nuances are missing.

Above normal monsoon and delay in its withdrawal as well as a massive shortage of urea across the country, may end up reducing the harvest, the assessment of which is yet to be made. Higher rainfall towards the end of the monsoon waterlogs farmland, killing or stunting crops; inadequate urea stunts crop growth.

Also read: What changes from October 1: Key financial and regulatory updates

GST reforms, capacity utilisation

The impact of GST rate cuts on the consumption boost is not known yet. It came into effect on September 22, three weeks after it was first announced on August 15. This gap led to deferred purchases. NielsenIQ reported a fall of 5-25 per cent in sales of FMCG products like large grocery packs, soft drinks, refrigerators, air conditioners and smartphones in the September quarter, attributing it to this factor.

Capacity utilisation in manufacturing has crossed 75 per cent – up by 20 basis points from the previous quarter to 75.5 per cent (seasonally adjusted) in Q4 of FY25. This is a healthy indication because of sub-75 per cent capacity utilisation for years but not good enough to warrant fresh investment in production. When private investment was robust earlier, capacity utilisation was close to 80 per cent or more during FY10-FY12.

State of SCBs

The system-level financial parameters related to capital adequacy, liquidity, asset quality, and profitability of the SCBs (Scheduled Commercial Banks) may be healthy, but it is not translating into either credit growth or deposit growth. The governor acknowledges these too, and yet glosses over by saying that the “total flow of resources from non-bank sources to the commercial sector increased by ₹2.66 lakh crore in 2025-26 so far, more than offsetting the decline in non-food bank credit by ₹0.48 lakh crore.”

Also read: How Centre flouted GST law, diverted ₹3.1 lakh crore meant for states

The NBFCs (Non-Banking Financial Companies) and SCBs can’t be equated because the former is mainly for personal loans for consumption – not to the industry or services sectors.

That is why the governor went on to list five measures to raise bank credit outflows:

(i) Provide an enabling framework for banks to finance acquisitions of foreign assets by Indian corporates

(ii) Remove ceiling on lending against listed debt securities, enhance limits for lending against shares and IPOs

(iii) Proposal to raise credit limit to ₹10,000 crore and above to specified corporates

(iv) Lower risk weights for NBFCs for infrastructure projects and

(v) Lift the ban on licensing Urban Co-operative Banks (UCBs)

The RBI’s data shows that, having halved from 20 per cent in FY24 to 11 per cent in FY25, bank credit growth (SCBs) to the non-food sector went down to 1.3 per cent in July over March 2025 (FY26) – which is lower than 2.3 per cent in the corresponding FY25.

Private corporate investments see no revival

The governor skipped mentioning private corporate investment – which refuses to revive despite multiple fiscal incentives and adequate liquidity in the banking system for years. As for growth in the services sector, there is nothing new in it. Besides, the governor acknowledged that “during July-August 2025, merchandise trade deficit continued to remain elevated” and that “the trade-related uncertainties are also unfolding”.

Also read: GST 2.0: Relief for pharma, pain for textiles, ceramics and MSMEs in Gujarat

Meanwhile, the rupee has depreciated by 3.7 per cent against the USD in H1 of FY26 – among the worst-performing Asian currencies. This depreciation raises import costs, adds to inflation, and raises debt burden. The RBI’s September 30 statement says India’s external debt at the end of June 2025 had gone up by $11.2 billion (over end-March 2025), which would have been only $6.2 billion without the rupee devaluation.

Rupee depreciation, rise in external debt

That is, rupee devaluation alone added 45 per cent to the rise in external debt during the April-June 2025 quarter. Imagine the impact at the end of four quarters of FY26. Meanwhile, FPIs continue to pull out, putting more downward pressure on the rupee. During April-September, they pulled out a net of $4.2 billion from the equity market. One good news, however, is that the net FDI inflows is increasing, driven by higher gross inflows and “moderation” in repatriation and outward FDI.

Also read: Why new GST rates are a shot in the arm for auto industry

But this rise in net FDI comes after net FDI inflows fell by 97 per cent in FY25 to $353 million – from $10.1 billion in FY24.

Surprise element: Move to internationalise rupee

A surprise element of the RBI governor’s address is measures for “internationalising rupee”. India had stepped back from the rupee trade when US President Donald Trump threatened the BRICS from doing anything that would undermine the USD in global trade.

Malhotra announced three measures: (i) Permit authorised banks to lend in rupees to non-residents from Bhutan, Nepal and Sri Lanka for cross border trade transactions; (ii) Establish transparent reference rates for currencies of India’s major trading partners to facilitate rupee-based transactions and (iii) Permit wider use of Special Rupee Vostro Account (SRVA) balances by making them eligible for investment in corporate bonds and commercial papers.