GST cut: MPs will monitor if benefits are passed on to customers

Says that during former prime minister Indira Gandhi’s tenure, India had some of the highest income tax rates in the world

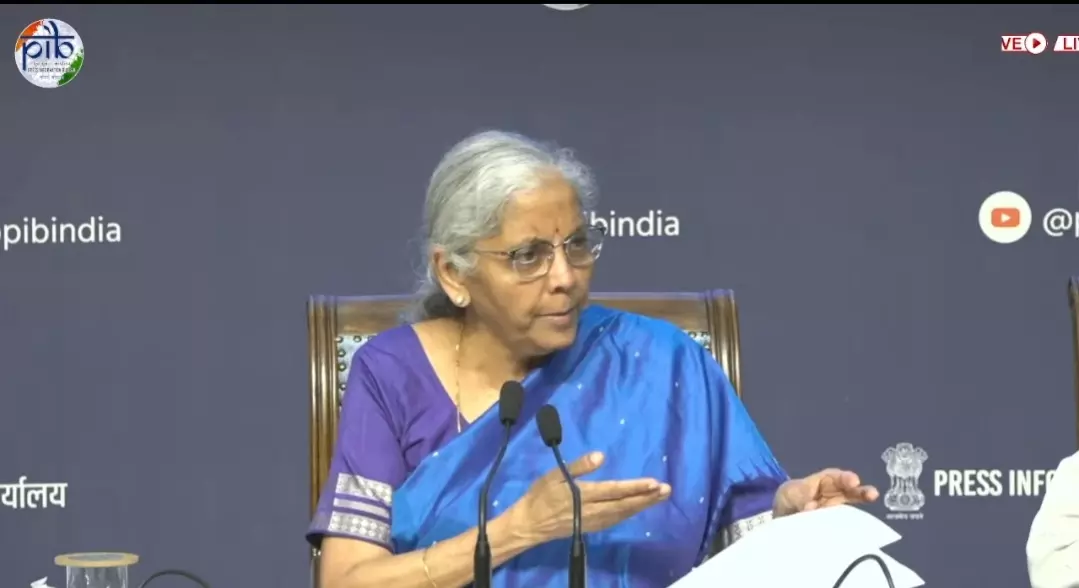

Finance Minister Nirmala Sitharaman criticised the Congress for rushing to claim credit for the Goods and Services Tax (GST) reforms, reminding that it was the same party that had once labelled it the “Gabbar Singh Tax.”

Sitharaman assured that the government was closely monitoring compliance and that the GST benefits would be passed on to the consumers.

Also Read: GST reform shows how indirect taxes can be made even more indirect

91 percent tax era

She argued that the opposition’s eagerness to take credit for what she termed "GST 2.0" was itself a vindication of the government’s reforms.

"Those who mocked GST as a Gabbar Singh Tax are today keen to claim credit for it. The Congress should explain why it failed to implement GST during its time in power," she told India Today.

In an exclusive interview with India Today, Sitharaman highlighted that during former Prime Minister Indira Gandhi’s tenure, India had some of the highest income tax rates in the world.

She also pointed out that under Indira Gandhi, the Congress government imposed an income tax of 91 percent.

"If someone earned Rs 100 in those days, Rs 91 went in taxes. Those who once levied a 91 percent tax are now seeking credit for GST," she remarked.

Also Read: GST reforms split Opposition States: Kerala protests, Tamil Nadu cautious

Govt assures compliance

The Finance Minister said the government was working to ensure that reductions in GST rates were passed on to the public.

"The GST cut benefits will be transferred and passed on to the people by industry," she said, adding that the first few months would focus on last-mile implementation and corrective action.

She added that even MPs would track the implementation of rate cuts on the ground.

"Me, my department, the CBIC (Central Board of Indirect Taxes and Customs) will be closely monitoring this process and taking corrective measures wherever necessary," Sitharaman said.