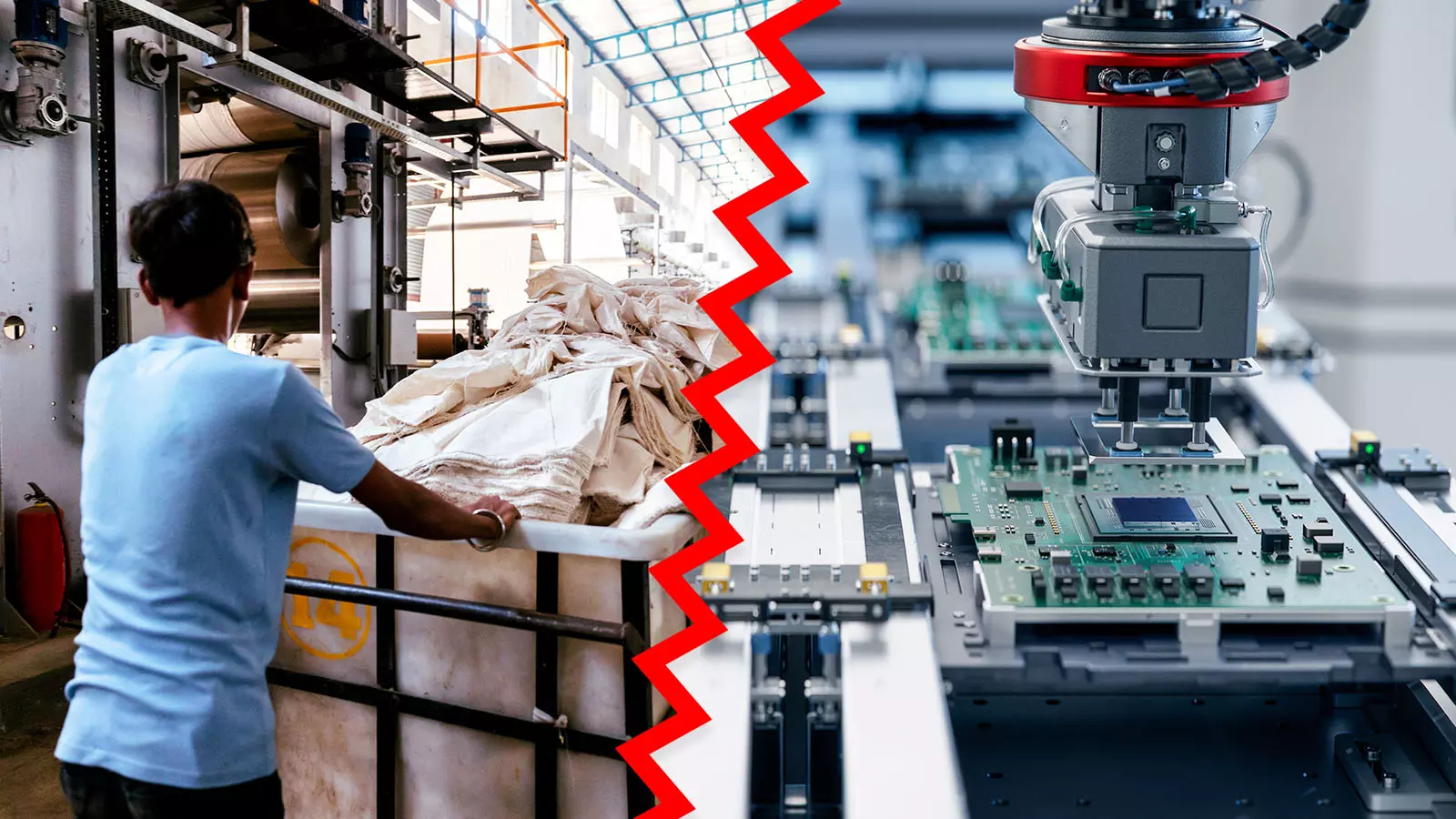

TN's electronics sector powers up with PLI while textiles fray at edges

Recalibrated PLI framework, with lower investment thresholds, could Tamil Nadu help replicate the electronics sector’s success across other industries

Tamil Nadu has long been a leader in manufacturing, but its rise as an electronics powerhouse in recent years has been nothing short of remarkable. Thanks to the Production-Linked Incentive (PLI) 1.0 scheme, the state's electronics exports skyrocketed from $1.6 billion in FY21 to $11 billion in FY24—a staggering seven-fold increase.

This growth far outpaced other key industries like engineering goods ($14.8 billion in FY24, up 34%) and textiles ($6.2 billion, up 9%), proving that electronics has become the defining success story of Tamil Nadu’s manufacturing expansion.

Also read: Unmaking of a gamechanger: Why India’s PLI scheme fell short

This unprecedented success has now set the stage for PLI 2.0, which expands incentives to IT hardware manufacturing. Tamil Nadu is already capitalising on this shift, securing “seven out of 27 approved units” under the new scheme and attracting major global players like HP and Dixon Technologies. The initiative promises a production value of Rs 3.5 lakh crore and 47,000 new jobs nationwide.

Why electronics soared

The key to Tamil Nadu’s electronics success isn’t just the PLI scheme itself, but the strong ecosystem the state has built over the years. Tamil Nadu Industries Minister TRB Rajaa told The Federal that the PLI scheme acted as a catalyst, but the foundation was already in place.

“The success of the PLI scheme in the electronics sector in Tamil Nadu is not accidental – it is the result of years of building a strong, well-rounded ecosystem with the right talent pool. While the PLI scheme has been an effective policy tool nudging investors towards India, what truly made it work in TN’s electronics sector is the robust foundation that was already in place.”

He points to Tamil Nadu’s long-term investments in education, skilling initiatives like “Naan Mudhalvan”, industrial infrastructure, and engagement with global original equipment manufacturers (OEMs) as key differentiators. The state has worked consistently to attract high-value investments by ensuring policy continuity, ease of doing business, and labour welfare, he said.

Global players bet on TN

Tamil Nadu’s ability to attract global electronics giants is evident in the recent investments under PLI 2.0.

HP Inc. has partnered with Dixon Technologies' subsidiary, Padget Electronics, to manufacture laptops, desktops, and all-in-one PCs at a new 300,000-square-foot facility in Oragadam. The plant, capable of producing two million units annually, is expected to create 1,500 direct jobs. The fact that seven of the 27 approved units under PLI 2.0 are in Tamil Nadu underscores the state’s growing dominance in electronics manufacturing.

Yet, despite this success, questions remain about the nature of manufacturing taking place in the state. Madan Sabnavis, Chief Economist, Bank of Baroda, raises an important point about the extent of true indigenous production: “When it comes to electronics, I don’t know how much of fully indigenous manufacturing is happening in Tamil Nadu. Are we importing parts and just assembling them here? Or is it truly indigenous production with the parts also being sourced locally? But irrespective of the type of manufacturing done here, it is easier to meet production targets under PLI in sunrise industries like EV and electronics.”

Textiles struggle to capitalise

While PLI 1.0 revolutionised Tamil Nadu’s electronics sector, the textile industry—despite being a historical stronghold—failed to benefit similarly. Several factors contributed to this struggle, including high global competition from Bangladesh and Vietnam, which offer lower labour costs and aggressive trade policies. Additionally, capital-intensive investments made it difficult for textile firms to achieve a return comparable to electronics.

Also read: TN cities outperform national average in sustainability, but challenges remain: CII

Sabnavis outlines the fundamental issue with applying PLI to textiles, saying, “The PLI scheme may not have achieved the desired outcomes in textiles due to market saturation. Both domestic and export markets have limitations, especially during economic downturns when consumer demand is suppressed. Indian manufacturers face questions like—If I produce, where do I sell? Do I have the capacity to scale up? The machinery and people? This may be why, during the crisis in Bangladesh, despite expectations, India did not capitalise on the opportunity to fill the market gap.”

The investment barrier

A major stumbling block for the textile sector under PLI is the high investment threshold. The scheme mandates a minimum investment of Rs 100 crore and a turnover of Rs 200 crore—targets that most textile companies in India struggle to meet.

A. Sakthivel, Honorary Chairman, Tiruppur Exporters Association, highlights this issue, saying, “The minimum investment threshold of Rs 100 crore and turnover of Rs 200 crore is, realistically speaking, not possible. There are very few textile companies in the country operating on that scale. That is why we have petitioned the textiles ministry and the Prime Minister’s Office (PMO) to reduce the investment threshold to Rs 25 crore and the turnover to Rs 50 crore for more MSME players in the textile space to operate.”

Another challenge is the scheme’s focus on man-made fibre textiles, which requires a shift away from traditional cotton production. While this presents an opportunity for diversification, it also demands significant adjustments in production processes and supply chains.

A tale of two industries

The PLI scheme’s divergent outcomes in Tamil Nadu’s electronics and textile sectors highlight the need for industry-specific policy adaptations.

Minister Rajaa acknowledges this reality: “PLI schemes alone cannot transform an industry, as we can see in many other sectors. They work best when there is a well-established ecosystem and a skilled talent pool ready to deliver value to investors.”

Also read: TN Budget 2025 tries to negotiate choppy fiscal waters amid dwindling Central funds

While Tamil Nadu’s electronics industry has leveraged PLI to become a national leader, the textile sector continues to grapple with structural challenges.

Moving forward, a recalibrated PLI framework, with lower investment thresholds and a more tailored approach for textiles, could help replicate the electronics sector’s success across other industries. If these adjustments are made, Tamil Nadu may well solidify its status not just as India’s electronics capital, but as a balanced, diversified manufacturing powerhouse, say industry insiders.