Wall St totters with Trump tariffs, but Asian markets open on bullish note

S&P 500 dips 1.7 pc in midday trading, Dow Jones down 860 points, Nasdaq Composite falls 1.4 pc; on Tuesday, Nikkei rises 5.5 pc to recover from Bloody Monday

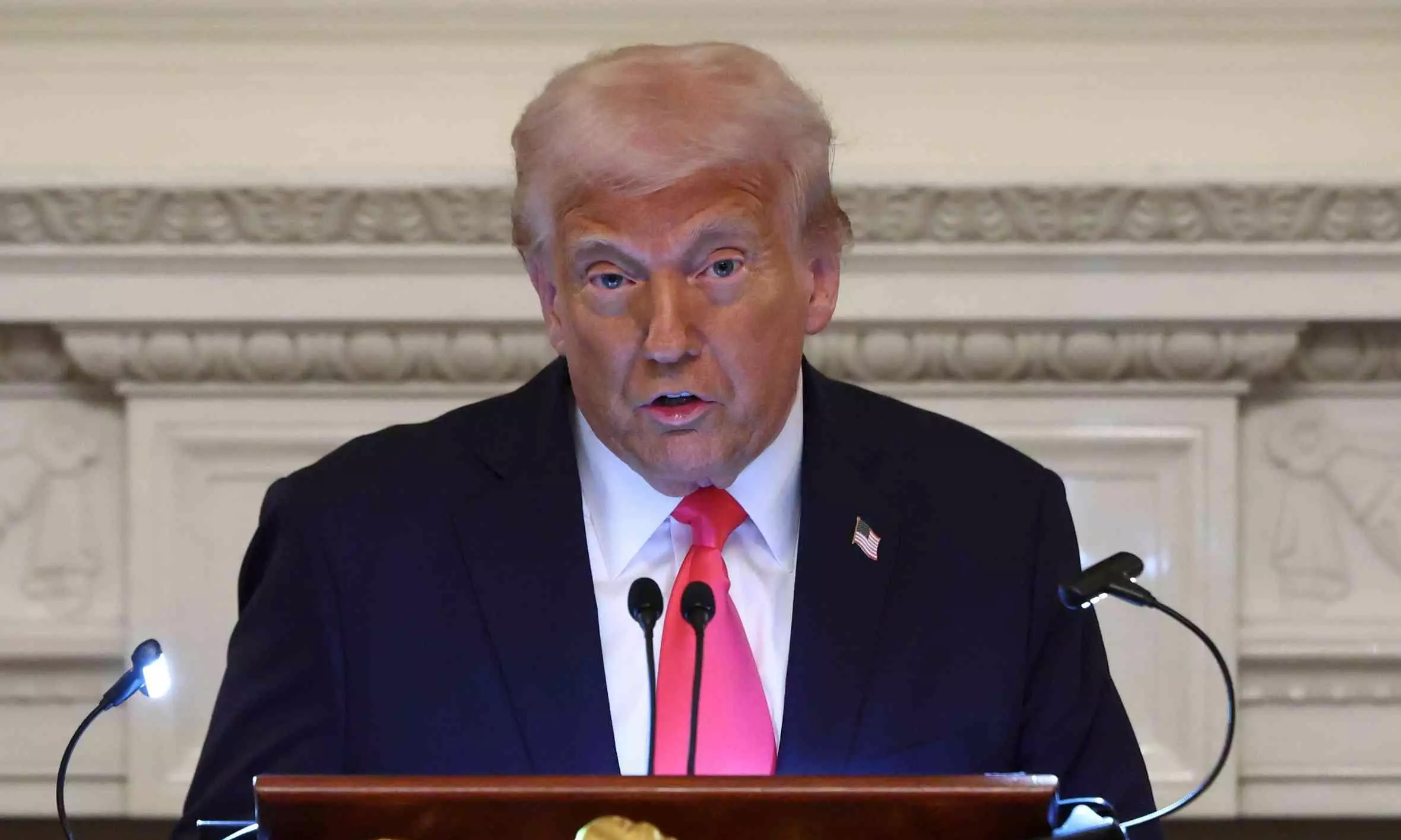

Wall Street on Monday (April 7) showed a downward slide with all three major indexes crashing for a third day in a row after US President Donald Trump doubled down on his tariffs.

Weak trend

The S&P 500 was down 1.7 per cent in midday trading, coming off its worst week since COVID began crashing the global economy in March 2020. The index, which sits at the heart of many investors' 401(k) accounts, has been flirting with a drop of 20 per cent from its record set less than two months ago.

The Dow Jones Industrial Average was down 860 points, or 2.2 per cent, as of 1:05 pm Eastern time, and the Nasdaq composite was 1.4 per cent lower.

Earlier in a heart-racing morning, the Dow plunged as many as 1,700 points shortly after trading began, following even worse losses worldwide on worries that Trump's tariffs could torpedo the global economy.

Also read: With Black Monday, 10 highlights of Sensex in 11 years of Modi rule

False rumour triggers surge

But it suddenly surged to a leap of nearly 900 points. The S&P 500 went from a loss of 4.7 per cent to a gain of 3.4 per cent, which would have been its biggest jump in years.

The sudden rise for stocks followed a false rumour that Trump was considering a 90-day pause on his tariffs. The White House quickly quelled the rumour as “fake news” in a post on X. Stocks then turned back down.

That a rumour could move trillions of dollars' worth of investments shows how much investors are hoping to see signs that Trump may let up on his stiff tariffs, which have started a global trade war.

Trump’s threat to China

Soon after that, Trump threatened to raise tariffs further against China after the world's second-largest economy retaliated last week with its own set of tariffs on US products.

It's a slap in the face to Wall Street, not just because of the sharp losses it's taking, but because it suggests Trump may not be moved by its pain. Many professional investors had long thought that a president who used to crow about records reached under his watch would pull back on policies if they sent the Dow reeling.

Also read: Sensex nosedives over 3,939 points, Nifty slumps 1,160 points amid Trump tariff fears

Asian markets open higher

Asian markets, however, opened higher on Tuesday (April 8), with Japan's Nikkei 225 share benchmark up 5.5 per cent after it fell nearly 8 per cent a day earlier.

The Nikkei 225 had jumped to 32,819.08 a half-hour after the market in Tokyo opened.

South Korea's Kospi gained 2 per cent and markets in New Zealand and Australia also were higher.

Asian markets had plunged on Monday, with stocks in Hong Kong diving 13.2 per cent for their worst day since 1997, during the Asian financial crisis.

Also read: Japan's Nikkei 225 stock index up 5.5 pc as world markets gyrate under tariff uncertainty

Trump defends tariffs

On Sunday Trump told reporters aboard Air Force One that he does not want markets to fall. But he also said he wasn't concerned about a sell-off, saying “sometimes you have to take medicine to fix something.”

Trump has given several reasons for his stiff tariffs, including to bring manufacturing jobs back to the United States, which is a process that could take years. Trump on Sunday said he wanted to bring down the numbers for how much more the United States imports from other countries versus how much it sends to them.

Inflation, recession fears

“The recent tariffs will likely increase inflation and are causing many to consider a greater probability of a recession,” JPMorgan CEO Jamie Dimon, one of the most influential executives on Wall Street, wrote in his annual letter to shareholders Monday.

“Whether or not the menu of tariffs causes a recession remains in question, but it will slow down growth.”

The financial pain once again hammered investments around the world on Monday, the third straight day of steep losses after Trump announced tariffs in his “Liberation Day.”

Also read: Trump threatens 50 per cent more tariffs on China

Stocks in Hong Kong plunged 13.2 per cent for their worst day since 1997. A barrel of benchmark US crude oil dipped below USD 60 during the morning for the first time since 2021, hurt by worries that a global economy weakened by trade barriers will burn less fuel.

Bitcoin sank below USD 79,000, down from its record above USD 100,000 set in January, after holding steadier than other markets last week.

Attack on globalisation

On Wall Street, nearly 90 per cent of the stocks fell within the S&P 500.

Nike dropped 6.1 per cent for one of the larger losses in the market. Not only does it sell a lot of shoes and apparel in China, it also makes much of it there. Last fiscal year, factories in China made 18 per cent of its Nike brand footwear. Vietnam made 50 per cent, and Indonesia made 27 per cent.

Trump's tariffs are an attack on the globalisation that's remade the world's economy, which helped bring down prices for products on the shelves of US stores but also caused production jobs to leave for other countries.

It also adds pressure on the Federal Reserve. Investors have become nearly conditioned to expect the central bank to swoop in as a hero during downturns.

Pressure on Federal Reserve

By slashing interest rates to make borrowing easier for US households and companies, along with several untraditional moves to juice the economy, the Fed helped the US economy recover from the 2008 financial crisis, the 2020 COVID crash and other bear markets.

But the Fed may have less freedom to act this time around because the conditions are so much different. For one, instead of a coronavirus or a system built up on too much belief that US home prices would keep rising, this market downturn is mostly because of economic policy from the White House.

Perhaps more importantly, inflation is also higher at the moment than the Fed would like. And while lower interest rates can goose the economy, they can also put upward pressure on inflation.

Also read: Black Monday bloodbath: Global markets crash amid fear of escalation in trade war

Expectations for inflation are already swinging higher because of Trump's tariffs, which would likely raise prices for anything imported.

“The idea that there's so much uncertainty going forward about how these tariffs are going to play out, that's what's really driving this plummet in the stock prices,” said Rintaro Nishimura, an associate at the Asia Group.

Nathan Thooft, a senior portfolio manager at Manulife Investment Management, told AP that more countries are likely to respond to the US with retaliatory tariffs. Given the large number of countries involved, “it will take a considerable amount of time in our view to work through the various negotiations that are likely to happen.” “Ultimately, our take is market uncertainly and volatility are likely to persist for some time,” he said.

(With inputs from agencies)