Economic Survey LIVE | 'India must prioritise investment in grid infra, critical minerals'

Fundamentals of domestic economy remain robust, with strong external account, calibrated fiscal consolidation and stable private consumption, says Survey

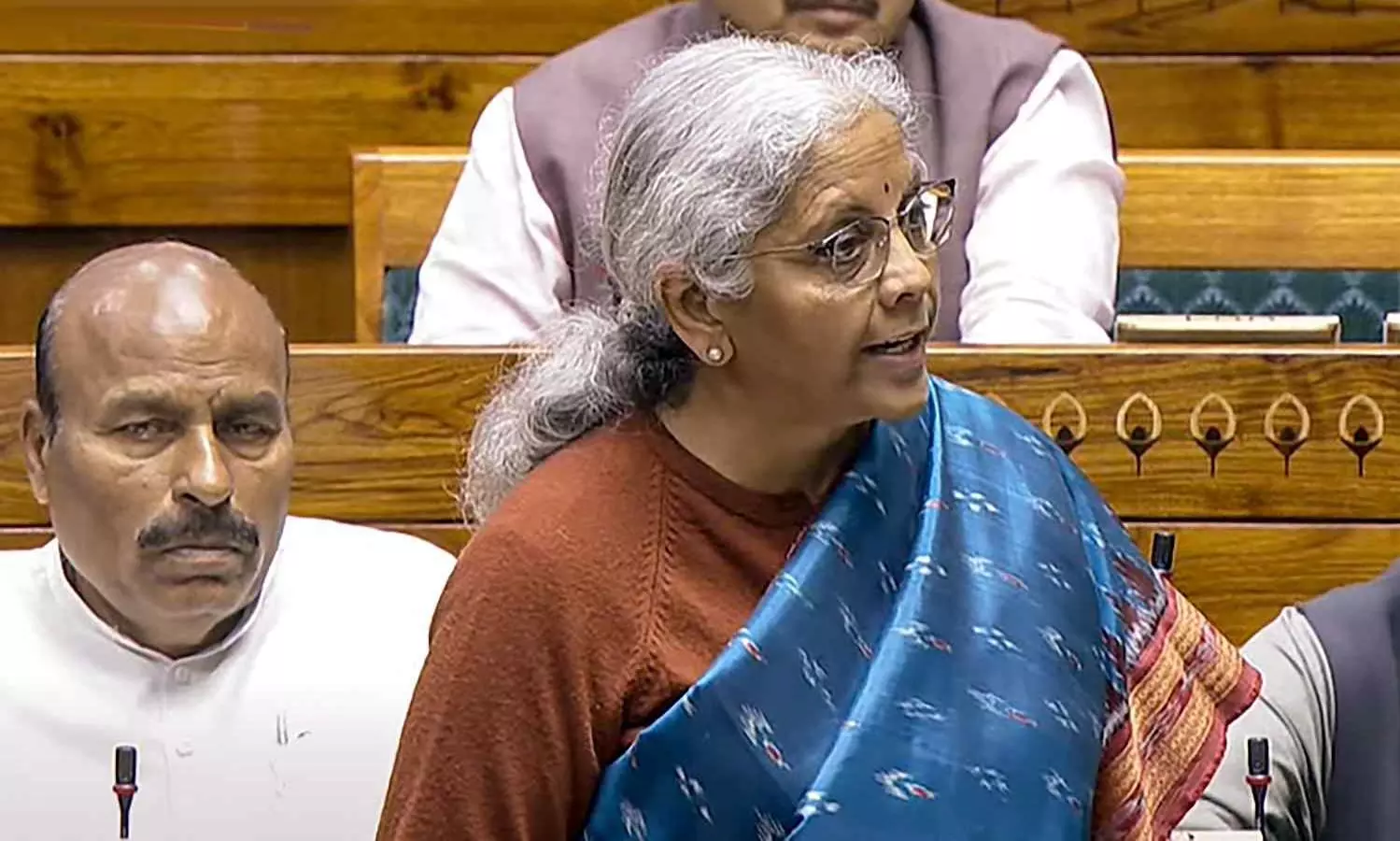

Union Finance Minister Nirmala Sitharaman on Friday (January 31) tabled the Economic Survey 2024-25 in the Lok Sabha. The pre-Budget document projected GDP growth of 6.3 to 6.8 per cent for FY26, saying: "The fundamentals of the domestic economy remain robust, with a strong external account, calibrated fiscal consolidation and stable private consumption."

After several quarters of high food inflation, the Survey predicted that food inflation is "likely to soften" in Q4.

Also read | Economic Survey | Paradox: India Inc profits soar, but wage growth dips

Touching upon Ease of Doing Business 2.0, the document said: "The government should be ‘getting out of the way’ and allow businesses to focus on their core mission."

Renewable push

India must prioritise investment in extensive grid infrastructure improvements and secure sourcing of critical minerals to strengthen its renewable energy initiatives, suggested the Survey.

The document tabled in Parliament on Friday noted that despite being one of the world’s lowest greenhouse gas emitters per capita, India has made notable strides in reducing the emissions intensity of its energy consumption. This progress is largely due to the increased deployment of renewable energy sources alongside a suite of energy conservation measures, it also noted.

Also read | Economic Survey | Slowing growth presents reality check for Viksit Bharat

Budget Session begins

The Budget Session of the Parliament began earlier today with President Droupadi Murmu addressing the joint sitting of the two Houses.

The government has listed 16 Bills, besides the financial business, for the Budget session which will be held from January 31 to February 13 before breaking for recess to examine the Budget proposals. The session will reconvene on March 10 and continue till April 4.

Read updates here:

Live Updates

- 31 Jan 2025 2:21 PM IST

Summary of Chapter 4 of the Economic Survey 2024-25

Here is a summary of Chapter 4 of the Economic Survey 2024-25, titled "Prices and Inflation: Understanding the Dynamics", highlighting key figures and statistics:

Global Inflation Trends:

Peak and Decline:

Global inflation peaked at 8.7% in 2022 due to supply chain disruptions and geopolitical tensions.

It declined to 5.7% in 2024, aided by policy measures.

India's Inflation Overview:

Retail Inflation:

Moderated from 5.4% in FY24 to 4.9% in FY25 (April–December).

Core Inflation:

Reached its lowest point in a decade during this period.

Food Inflation Dynamics:

Key Contributors:

Vegetables and pulses, with a combined weight of 8.42% in the CPI basket, contributed 32.3% to overall inflation in FY25 (April–December).

Impact of Specific Items:

Excluding vegetables and pulses, the average food inflation rate was 4.3%, 4.1 percentage points lower than the overall food inflation.

Similarly, excluding these items, the average headline inflation was 3.2%, 1.7 percentage points lower than the actual headline inflation.

Factors Influencing Food Prices:

Extreme Weather Events:

Increased frequency of heatwaves, with India experiencing heatwaves on 18% of days during 2022–2024, up from 5% in 2020 and 2021.

Total crop area damaged due to extreme weather events was higher in 2024 compared to the previous two years.

Government Measures to Control Food Inflation:

Cereals:

Imposed stock limits on wheat from June 24, 2024, to March 31, 2025.

Offloaded wheat and rice from the central pool under the Open Market Sale Scheme.

Pulses:

Allowed duty-free import of desi chana, tur, urad, and masur until March 31, 2025.

Imposed stock limits on tur and desi chana from June 21, 2024, to September 30, 2024.

Vegetables:

Procured 4.7 lakh metric tonnes of rabi onion under the Price Stabilisation Fund.

Imposed a 20% export duty on onion since September 13, 2024.

Subsidised sale of onion at ₹35 per kg from September to December 2024.

Subsidised sale of tomato at ₹65 per kg in October 2024.

Outlook:

Inflation Projections:

The Reserve Bank of India (RBI) revised its inflation projection for FY25 from 4.5% to 4.8%.

Assuming a normal monsoon and no further external shocks, the RBI expects headline inflation to be 4.2% in FY26.

The International Monetary Fund (IMF) projects an inflation rate of 4.4% for FY25 and 4.1% for FY26 for India.

Commodity Prices:

The World Bank's Commodity Markets Outlook (October 2024) forecasts a 5.1% decrease in commodity prices in 2025 and a 1.7% decrease in 2026, led by declines in oil prices.

The survey emphasizes the importance of robust data systems for monitoring prices, developing climate-resilient crops, and reducing crop damage and post-harvest losses to achieve long-term price stability.

- 31 Jan 2025 2:19 PM IST

Summary of Chapter 3 of the Economic Survey 2024-25

Here is a summary of Chapter 3 of the Economic Survey 2024-25, titled "External Sector: Getting FDI Right", highlighting key figures and statistics:

Trade Performance:

Total Exports:

In the first nine months of FY25, India's total exports (merchandise and services) reached USD 602.6 billion, marking a 6% growth.

Exports of services and goods, excluding petroleum and gems and jewellery, grew by 10.4%.

Total Imports:

During the same period, total imports stood at USD 682.2 billion, registering a 6.9% increase, driven by steady domestic demand.

Foreign Direct Investment (FDI):

Gross FDI Inflows:

In the first eight months of FY25, gross FDI inflows showed signs of revival.

Net FDI Inflows:

Despite the increase in gross inflows, net FDI inflows declined compared to April-November 2023, primarily due to a rise in repatriation and disinvestment activities.

Foreign Portfolio Investments (FPI):

Trends:

FPIs exhibited a mixed trend in FY25. While global market uncertainties and profit-taking led to capital outflows, India's strong macroeconomic fundamentals and high economic growth ensured overall positive FPI flows.

Foreign Exchange Reserves:

Reserve Levels:

As of December 2024, India's foreign exchange reserves stood at USD 640.3 billion.

These reserves were sufficient to cover approximately 90% of the country's external debt, which was USD 711.8 billion as of September 2024, providing a robust buffer against external vulnerabilities.

Global Economic Uncertainty:

Impact on Growth:

The International Monetary Fund (IMF) estimates that a one standard deviation increase in uncertainty correlates with a 0.4 to 1.3 percentage point decrease in output growth.

Uncertainty Indices:

As of November 2024, the Global Economic Policy Uncertainty (GEPU) index remained elevated, reflecting ongoing global economic policy concerns.

The Trade Policy Uncertainty (TPU) index has risen since December 2023, driven by trade tensions and policy changes among major economies.

The survey underscores the importance of adapting to evolving global trade dynamics and leveraging India's strengths to enhance its presence in global trade. It advocates for reducing trade-related costs and enhancing export facilitation to strengthen competitiveness and further integrate into global supply chains.

- 31 Jan 2025 2:18 PM IST

Summary of Chapter 2 of the Economic Survey 2024-25

Here is a summary of Chapter 2 of the Economic Survey 2024-25, titled "Monetary and Financial Sector Developments: The Cart and the Horse", highlighting key figures and statistics:

Monetary Developments:

Policy Rates:

Throughout the first nine months of FY25 (April–December 2024), the Reserve Bank of India's (RBI) Monetary Policy Committee maintained the policy repo rate at 6.5%.

Money Supply:

Reserve Money (M0) expanded by 10.2% year-on-year as of December 2024.

Broad Money (M3) grew by 9.8% during the same period.

The Money Multiplier stood at 5.5 in December 2024.

Banking Sector Performance:

Credit Growth:

Scheduled Commercial Banks (SCBs) reported a credit growth of 15.7% year-on-year as of December 2024.

Deposit growth for SCBs was 12.5% during the same period.

Asset Quality and Capital Adequacy:

Gross Non-Performing Assets (GNPA) ratio declined to 4.2% as of September 2024, improving from 5.7% in March 2023.

The Capital to Risk-Weighted Assets Ratio (CRAR) of SCBs improved to 17.1% in September 2024, up from 16.5% in March 2023.

Financial Inclusion:

Financial Inclusion Index:

The RBI's Financial Inclusion Index increased from 53.9 in March 2021 to 64.2 in March 2024.

Rural Financial Institutions (RFIs):

RFIs have played a significant role in advancing financial inclusion, particularly in rural areas.

Development Financial Institutions (DFIs):

Infrastructure Financing:

DFIs have been pivotal in financing infrastructure projects, contributing to economic development.

Capital Markets:

Market Performance:

As of December 2024, the Indian stock market reached new highs, consistently outperforming emerging market peers despite geopolitical uncertainties.

Initial Public Offerings (IPOs):

The number of IPOs increased sixfold between FY13 and FY24, indicating a rise in equity-based financing.

Insurance and Pension Sectors:

Coverage Expansion:

Both sectors continue to work towards universal coverage, strengthening the financial ecosystem.

Emerging Trends and Risks:

Consumer Credit:

There's an increasing share of consumer credit in overall bank credit, with a notable rise in unsecured lending.

Non-Bank Financing:

Alternative financing options beyond traditional banks are expanding.

Young Investors:

A growing number of young investors are participating in capital markets.

The survey emphasizes the need for balanced regulation to foster financial sector growth while ensuring stability and resilience.

- 31 Jan 2025 2:14 PM IST

Chapter 4 - PRICES AND INFLATION: UNDERSTANDING THE DYNAMICS

In gauging the health of the global economy, understanding the trends in inflation is essential. While global inflation peaked in 2022 due to supply chain disruptions and geopolitical tensions, it has declined since then, aided by policy measures. In India, retail inflation eased in FY25 due to timely interventions by the government and the Reserve Bank of India. Core inflation reached its lowest point in a decade, while food inflation was affected by supply chain disruptions and adverse weather conditions.

Onion and tomato prices are affected by the decline in production, partly due to extreme weather conditions and monsoon-induced supply chain disruptions. On pulses, despite being a major producer, India faces a gap in demand and supply. The government has undertaken several measures to rein in the prices of vegetables like onion and tomato which included procurement and buffer stocking of onion under price stabilisation fund and subsidised sale of onion and tomato. Also, many administrative measures have been taken-up to address the price pressures in pulses such as subsidised retail sale, stock limits and easing imports.

Estimates suggest that India's retail price inflation will align progressively with the target. Global commodity prices are expected to decline, potentially easing core and food inflation. Long-term price stability could be achieved by robust data systems for monitoring prices, developing climate-resilient crops, reducing crop damage and post-harvest losses.

- 31 Jan 2025 2:10 PM IST

Chapter 3: EXTERNAL SECTOR: GETTING FDI RIGHT

India’s external sector continued to display resilience amidst global headwinds of economic and trade policy uncertainties. Total exports (merchandise and services) have registered a steady growth in the first nine months of FY25, reaching USD 602.6 billion (6 per cent). Growth in services and goods exports, excluding petroleum and gems and jewellery, was 10.4 per cent. Total imports during the same period reached USD 682.2 billion, registering a growth of 6.9 per cent on the back of steady domestic demand.

The evolving global trade dynamics, marked by gradual shifts towards greater protectionism, require assessing the situation and developing a forwardlooking strategic trade roadmap. By adapting to these trends and leveraging its strengths, India can accelerate its growth and enhance its presence in global trade. To strengthen its competitiveness and further integrate into global supply chains, the country can focus on reducing trade-related costs and enhancing export facilitation to create a more vibrant export sector. This proactive approach will help India continue to thrive in an ever-changing global market. On the capital front, foreign portfolio investments (FPIs) have shown a mixed trend in FY25 so far. Uncertainty in the global markets and profittaking by foreign portfolio investors led to capital outflows. However, strong macroeconomic fundamentals, a favourable business environment, and high economic growth have kept FPI flows positive overall. Gross foreign direct investment (FDI) inflows have shown signs of revival in the first eight months of FY25, though net FDI inflows declined relative to April-November 2023 due to a rise in repatriation/disinvestment.

India’s foreign exchange reserves stood at USD 640.3 billion as of the end of December 2024, sufficient to cover approximately 90 per cent of the country’s external debt of USD 711.8 billion as of September 2024, reflecting a strong buffer against external vulnerabilities.

- 31 Jan 2025 2:08 PM IST

Chapter 2 - MONETARY AND FINANCIAL SECTOR DEVELOPMENTS: THE CART AND THE HORSE

The primary objective of monetary policy is to maintain price stability while also considering the goal of economic growth, as stable prices are essential for sustainable growth. The RBI employs various policy instruments, such as manoeuvring the interest rates, conducting open market operations (OMO), altering the cash reserve ratio (CRR) and statutory liquidity ratio (SLR), etc, to achieve this stability.

During the first nine months of FY25 (April 2024-December 2024), the Monetary Policy Committee (MPC) of the RBI, in its various meetings, decided to keep the policy repo rate unchanged at 6.5 per cent. Until its August 2024 meeting, the committee retained its stance on the ‘withdrawal of accommodation’ to ensure inflation aligns with the target while supporting growth. Considering the prevailing and expected inflation growth dynamics, the committee, in its October 2024 meeting, decided to change the policy stance from the ‘withdrawal of accommodation’ to ‘neutral’. In its December 2024 meeting, the MPC announced a cut in CRR to 4 per cent of the net demand and time liabilities (NDTL) from 4.5 per cent. The decision is expected to infuse around ₹1.16 lakh crore liquidity in the banking system.

- 31 Jan 2025 2:02 PM IST

Chapter 1 of the Economic Survey 2024-25

Here is a summary of Chapter 1 of the Economic Survey 2024-25, titled "State of the Economy: Getting Back into the Fast Lane," highlighting key figures and statistics:

Global Economic Scenario:

Global Growth:

The global economy grew by 3.3% in 2023.

The International Monetary Fund (IMF) projects growth of 3.2% for 2024 and 3.3% for 2025.

Regional Dynamics:

Advanced Economies (AEs) experienced stable growth in the first half of 2024, with the U.S. expected to grow by 2.8% in 2024.

The Euro area is projected to improve from 0.4% growth in 2023 to 0.8% in 2024 and 1.0% in 2025.

Sectoral Performance:

The global services sector showed resilience, with the Services PMI Business Activity Index reaching 53.8 in December 2024, indicating expansion for the twenty-third consecutive month.

The manufacturing sector faced challenges, with the Global Manufacturing PMI stabilizing at 50.0 in November 2024, indicating no overall change in operating conditions.

Inflation Trends:

Inflation rates have trended downward, approaching central bank targets, due to tighter monetary policies and adaptive supply chains.

Disinflation has slowed, with services inflation remaining persistent, partly due to higher nominal wage growth compared to pre-pandemic trends.

India's Economic Performance:

GDP Growth:

India's real GDP is estimated to grow by 6.4% in FY25, according to the first advance estimates.

Sectoral Contributions:

Agriculture is expected to grow by 3.8% in FY25, supported by record Kharif production and favorable conditions.

The industrial sector is estimated to grow by 6.2%, with strong performances in construction and utilities.

The services sector is projected to grow by 7.2%, driven by financial, real estate, professional services, public administration, and defense.

Private Consumption and Investment:

Private Final Consumption Expenditure (PFCE) is estimated to grow by 7.3% in FY25, with its share of GDP increasing from 60.3% in FY24 to 61.8% in FY25—the highest since FY03.

Gross Fixed Capital Formation (GFCF) is estimated to grow by 6.4% in FY25.

Fiscal and External Sector:

Fiscal Discipline:

The Union government's capital expenditure as a percentage of total expenditure has continuously improved since FY21, indicating a focus on fiscal discipline.

External Balance:

India's current account deficit (CAD) remained relatively contained at 1.2% of GDP in Q2 FY25, supported by a services trade surplus and healthy remittance growth.

Outlook and Challenges:

Growth Prospects:

India's economic growth for FY26 is projected to be between 6.3% and 6.8%.

Potential Headwinds:

Elevated geopolitical and trade uncertainties.

Possible commodity price shocks.

Domestic Drivers:

Sustained investment pick-up.

Improvements in consumer confidence.

Corporate wage growth.

Rebound in agricultural production.

Anticipated easing of food inflation.

Stable macroeconomic environment.

Overall, the survey emphasizes the need for grassroots-level structural reforms and deregulation to enhance India's medium-term growth potential.

- 31 Jan 2025 1:32 PM IST

Retail headline inflation softens from 5.4% to 4.9%

Retail headline inflation has softened from 5.4% in FY24 to 4.9% in April–December 2024, according to the Economic Survey 2024-25.

- 31 Jan 2025 1:32 PM IST

GDP growth forecast for FY26 between 6.3-6.8%

Keeping in mind the upsides and downsides to growth, real GDP growth in FY26 is expected to be between 6.3 and 6.8 per cent, according to the Economic Survey.

- 31 Jan 2025 1:30 PM IST

All sectors are performing well

The Economic Survey 2024-25 says that a trend analysis of quarterly de-seasonalised national income data reveals that all sectors are performing well.

The agriculture sector remains strong, consistently operating well above trend levels. The industrial sector has also found its footing above the pre-pandemic trajectory.

The robust rate of growth in recent years has taken the services sector close to its trend levels.