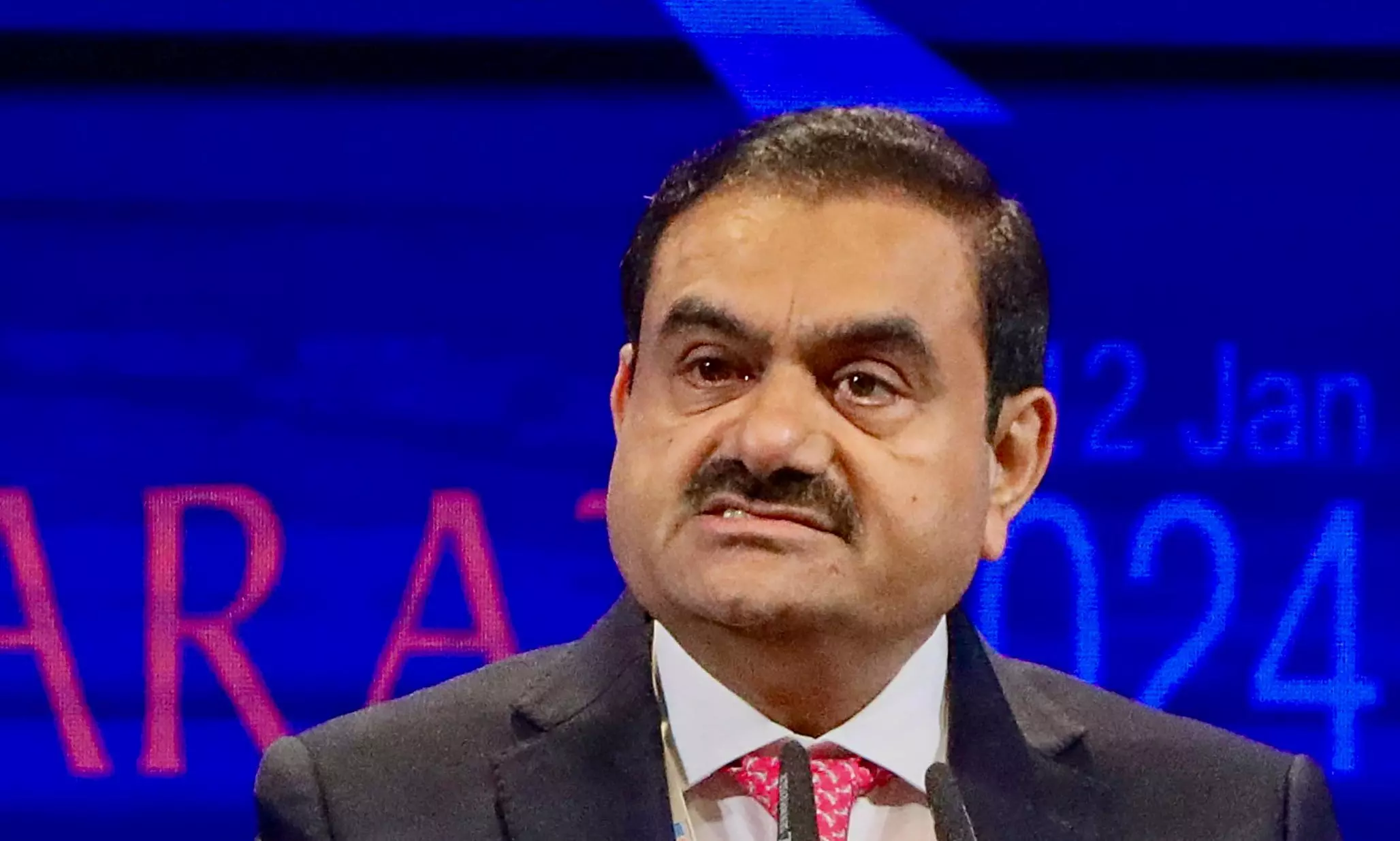

LIC denies Adani investments; Congress seeks PAC probe

Congress has demanded a PAC probe into LIC’s alleged investments in Adani Group after a Washington Post report claims so; LIC claims allegations are false

The Congress on Saturday (October 25) demanded that Parliament's Public Accounts Committee (PAC) investigate the Life Insurance Corporation (LIC) following a report by The Washington Post alleging that the public sector company made huge investments in Adani Group's securities after they took a beating in the markets.

However, LIC denied the allegations as "false, baseless, and far from the truth". Meanwhile, there was no response from the Adani group to the claims made in the article.

Also Read: Muhurat trading 2025: Stock markets open strong, Sensex rises 235 points

Congress slams Modi

Taking a swipe at the government over the issue, Congress president Mallikarjun Kharge said the real beneficiaries of the government's Direct Benefit Transfer initiative "are not the common people of India, but Modi's best friends".

This sharp criticism came after The Washington Post, citing internal documents, reported that Indian officials drafted and pushed through a proposal to invest about Rs 33,000 crores of LIC funds in various Adani Group companies in May 2025.

"Does the average salaried middle-class person, who pays every penny of their LIC premium, even know that Modi is using his savings to bail out Adani? Isn't this a breach of trust? Isn't it loot?" Kharge asked in a post on X.

He further questioned whether the Modi government would explain why LIC money was invested in Adani companies and why Rs 33,000 crore was planned to be invested in May 2025.

"Even before this, in 2023, despite a more than 32 per cent decline in Adani's shares, why was Rs 525 crore of LIC and SBI invested in the Adani FPO?" Kharge asked.

"Why is Modi busy filling the pockets of his 'best friend', looting the hard-earned money of 30 crore LIC policyholders?" Kharge added.

Also Read: Google to invest $15 billion in Vizag AI hub; Sundar Pichai calls it 'landmark move'

Systematic misuse

Congress General Secretary in charge of Communications, Jairam Ramesh, said the savings of LIC's policyholders were "systematically misused" to benefit the Adani Group.

In a statement, Ramesh said, "disturbing revelations just emerged in the media about how the Modani joint venture systematically misused the LIC and the savings of its 30 crore policyholders". He added, "The reported goals were to signal confidence in the Adani Group and to encourage participation from other investors".

"The question arises: under whose pressure did the officials of the Ministry of Finance and NITI Aayog decide that their job was to bail out a private company facing funding difficulties due to serious allegations of criminality? Is this not a textbook case of 'mobile phone banking'?" Ramesh asked.

He said the costs of "throwing public money at crony firms" became clear when LIC suffered "a staggering Rs 7,850 crore loss" in just four hours of trading on September 21, 2024, following the indictment of Gautam Adani and seven of his associates in the United States.

"Adani has been accused of orchestrating a Rs 2,000 crore bribery scheme to secure high-priced solar power contracts in India. The Modi government has refused, for nearly a year, to serve a US SEC summons to the Prime Minister's most favoured business conglomerate," Ramesh said.

'Modani MegaScam'

Ramesh claimed, "The Modani MegaScam is very wide-ranging. For instance, it encompasses: The misuse of agencies such as the ED, CBI, and Income Tax Department to force other private companies to sell their assets to the Adani Group." He also alleged that there was "rigged privatisation" of critical infrastructure assets such as airports and ports for the benefit of the Adani Group alone.

Ramesh pointed to alleged misuse of diplomatic resources to funnel contracts to the Adani Group in various countries, especially in India's neighbourhood.

He said the scam also encompasses the import of "over-invoiced coal by close Adani associates Nasser Ali Shaban Ahli and Chang Chung-Ling" using a money-laundering network of shell companies, which contributed to sharp increases in the prices of electricity drawn from Adani power stations in Gujarat and pointed to pre-election electricity supply agreements at "abnormally high prices" in Madhya Pradesh, Rajasthan and Maharashtra and the recent alleged allocation of land at Rs 1 per acre for a power plant in poll-bound Bihar.

"The entirety of this Modani MegaScam can only be investigated by a Joint Parliamentary Committee that the Congress has been demanding for almost three years - ever since we published our 100-question series Hum Adani Ke Hain Kaun (HAHK). As a first step, now at least PAC should fully investigate how LIC was forced to make investments in the Adani Group," Ramesh added.

Also Read: Adani compares Navi Mumbai airport to a lotus, says its gateway to India's future

Background: Hindenburg Research allegations

The Congress has been persistent in its attack on the government since the Adani Group stocks took a beating on the bourses in the wake of a report by Hindenburg Research, which made a litany of allegations. The Adani Group has dismissed Congress's charges as lies, saying it complied with all laws and disclosure requirements.

Markets regulator SEBI cleared the Adani Group of stock manipulation allegations made by US short-seller Hindenburg Research, saying fund transfer between group companies did not fall foul of any regulation. The SEBI probe was initiated after the Supreme Court's intervention.

Also Read: Adani to staff after SEBI closure: 'Cloud that hung over us lifted; time to accelerate'

LIC responds to allegations

In a statement posted on X, the LIC said the allegations levelled by The Washington Post that its investment decisions were influenced by external factors are "false, baseless, and far from the truth".

"The report carried statements with the intentions to prejudice the well-settled decision-making process of LIC and also to tarnish the reputation and image of LIC and the strong financial sector foundations in India," the statement read.

"No such document or plan as alleged in the article has ever been prepared by LIC that created a roadmap for infusing funds by LIC into the Adani group of companies. The investment decisions were taken by LIC independently as per Board-approved policies after detailed due diligence," the LIC noted, reiterating that the Department of Financial Services or any other body does not have any role in such decisions.

LIC ensured the highest standards of due diligence, and all its investment decisions have been undertaken in compliance with extant policies, provisions in the Acts and regulatory guidelines, in the best interest of all its stakeholders.

As per reports, LIC owns 4 per cent (Rs 60,000 crore) of Adani stocks versus 6.94 per cent (Rs 1.33 lakh crore) in Reliance, 15.86 per cent (Rs 82,800 crore) in ITC Ltd, 4.89 per cent (Rs 64,725 crore) in HDFC Bank, and 9.59 per cent (Rs 79,361 crore) in SBI. LIC holds 5.02 per cent of TCS worth Rs 5.7 lakh crore.

There was no immediate response from the Adani Group to the Congress's allegations.