MGNREGA vs VB-G RAM G: Increased state share adds financial strain on Karnataka

At present, if employment is provided to all registered families in the state as per the provisions of the new law (125 days of work annually), the additional financial burden is estimated at Rs 4,000-Rs 5,000 crore every year

The Union government’s move to replace the Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA) scheme with the Viksit Bharat - Guarantee for Rozgar and Ajeevika Mission (Gramin) (VB-G RAM G) has triggered concerns that it could deal a severe blow to Karnataka’s economy.

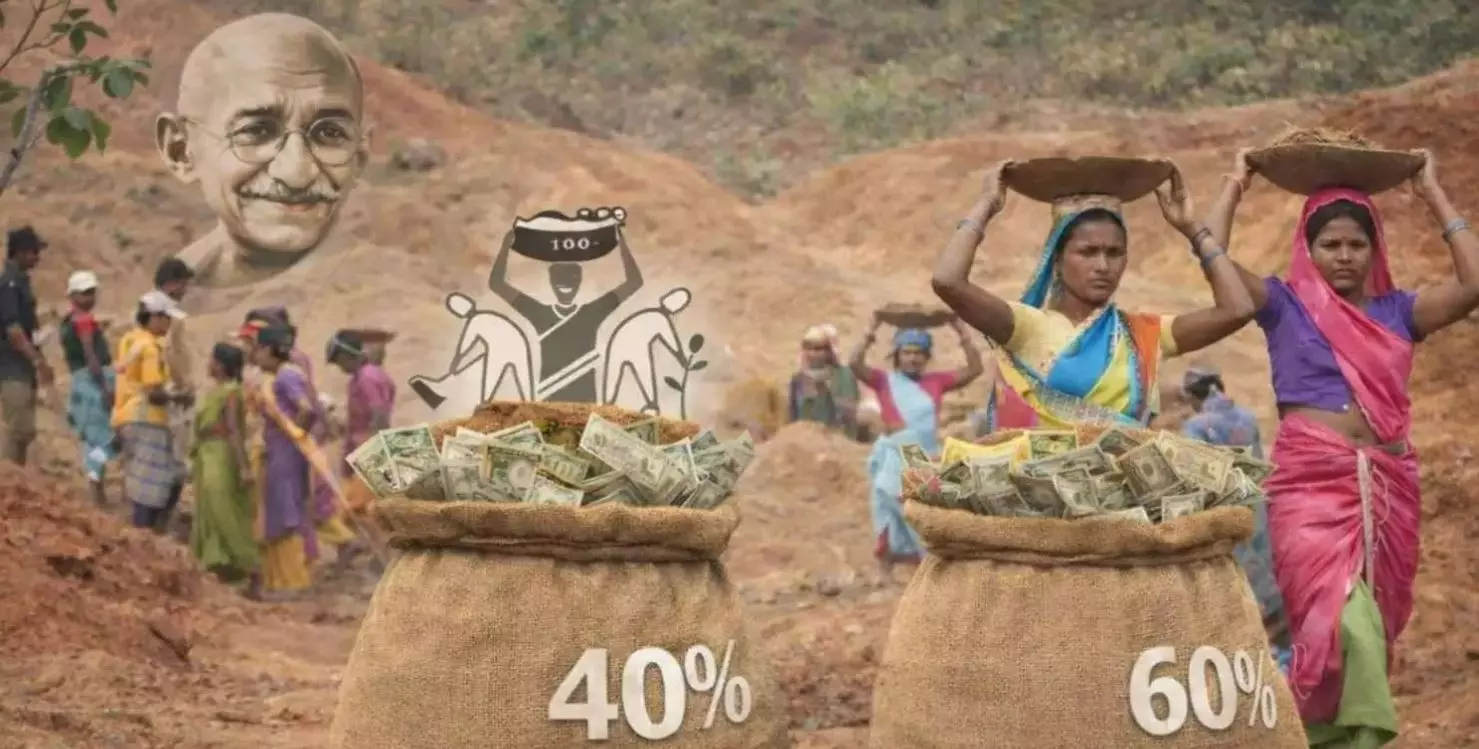

Under MGNREGA, the state’s contribution was limited to just 10 per cent. Under the new VB-G RAM G scheme, this has been raised sharply to 40 per cent. As a result, the state is expected to bear an additional annual burden of over Rs 2,000 crore.

Also read: Maharashtra leads India's startup tally; Karnataka secures second spot

The state government is already spending nearly Rs 50,000 crore every year on its guarantee schemes. With reduced Central allocations and limited scope for mobilising additional resources, funds earmarked for other programmes are being diverted to sustain these guarantees. This, officials warn, could push the state’s finances into an increasingly precarious position.

At present, if employment is provided to all registered families in the state as per the provisions of the new law (125 days of work annually), the additional financial burden is estimated at Rs 4,000-Rs 5,000 crore every year. Over a five-year period, this could add up to Rs 20,000-Rs 25,000 crore. Such pressure on the exchequer could constrain spending on other development works and deepen the state’s financial stress.

Annual expenditure of over Rs 2,000 crore

There are 80.9 lakh job card-holding families in the state. Under MGNREGA, employment was provided to only about 36 per cent of these households, with each family receiving an average of 45 days of work. The scheme followed a 90:10 funding ratio between the Centre and the state. Accordingly, a total of Rs 6,824 crore was spent in 2024-25, of which the Centre contributed Rs 6,251 crore and Karnataka Rs 573 crore.

Also read: Why VB-G RAM G raises fears over future of rural jobs in Andhra Pradesh

Under the new scheme, if funding is shared in a 60:40 ratio, the Centre would contribute over Rs 4,000 crore, while the state’s share would rise to more than Rs 2,000 crore. If all job card holders are provided the full entitlement of 125 days of work, annual expenditure would rise to Rs 4,000-Rs 5,000 crore. This steep increase is the primary reason the state government has strongly objected to the VB-G RAM G scheme.

Injustice in GST share as well

Karnataka ranks second in the country in Goods and Services Tax (GST) collections. In the 2025 financial year, the state collected Rs 1.60 lakh crore in GST.

Maharashtra topped the list with Rs 2.09 lakh crore, followed by Gujarat at Rs 1.40 lakh crore and Tamil Nadu at Rs 1.30 lakh crore. Uttar Pradesh, the largest state by area and population, ranked fifth with collections of Rs 1.05 lakh crore. The irony, however, is that states with lower GST collections receive a higher share of tax devolution, while Karnataka receives less. Despite raising the issue at the GST Council and staging protests in Delhi, the state has not received a tax share commensurate with its contribution, fuelling discontent.

Due to inadequate tax devolution from the Centre, the state estimates an annual revenue loss of nearly Rs 18,000 crore. This has already created funding constraints for welfare programmes. The increased state share under the VB-G RAM G scheme is expected to further aggravate Karnataka’s financial burden.

“In the last two-and-a-half years, 17 lakh rural assets worth Rs 21,144 crore have been created under MGNREGA in Karnataka. We have provided livelihoods to 80 lakh families. By increasing the state’s share under the VB-G RAM G scheme, the Centre is undermining welfare programmes. Central schemes are increasingly shifting the financial burden onto states. This will lead to higher unemployment in rural areas. Flaws in the new law will also reduce women’s participation,” Rural Development and Panchayat Raj Minister Priyank Kharge told The Federal Karnataka.

He added that employment would now be restricted to locations identified by the Centre. Under MGNREGA, job card holders could work anywhere, but the new Bill does not provide that flexibility. The increased funding share for states would adversely affect their finances, and over the next five years, Karnataka may have to spend nearly Rs 20,000 crore on the scheme alone.

Vivek Grewal, Managing Partner at Welllab, told The Federal Karnataka that the 60:40 funding ratio under the VB-G RAM G scheme would place a significant financial burden on state governments. Under MGNREGA, the Centre bore the bulk of the expenditure, but states will now have to shoulder a much larger share. Given the Centre-mandated ratio, existing state allocations will be insufficient, forcing states to set aside additional funds. This, he said, would inevitably stall or dilute other development programmes.

Funds due to the state not released

The Centre has withdrawn special grants recommended by the 15th Finance Commission. Funds amounting to Rs 5,490 crore, Rs 3,000 crore for lake development, Rs 3,000 crore for the Peripheral Ring Road, and Rs 5,000 crore for the Upper Bhadra project have not been released. Similarly, around Rs 17,000 crore remains pending across various schemes.

Three to four instalments due to panchayats have not been released, and even statutory grants recommended by the 15th Finance Commission are pending. Of the Rs 22,758 crore due under centrally sponsored schemes in 2024-25, nearly Rs 4,195 crore remains unpaid.

For the 2025-26 financial year, the Centre has earmarked an estimated Rs 51,876 crore as Karnataka’s tax share. While this is about 10 per cent higher than the previous year, the state argues it still represents a loss, as the 15th Finance Commission reduced Karnataka’s share from 4.71 per cent to 3.64 per cent.

Under social security schemes, the Centre allocated just Rs 559.61 crore for widow, old-age and disability pensions. However, only Rs 113.92 crore has been released so far. For the National Rural Drinking Water Programme, the Centre has pending dues of nearly Rs 10,000 crore over the past two years.

Under the Jal Jeevan Mission, against allocations of Rs 7,656 crore in 2023-24 and Rs 3,804 crore in 2024-25, only Rs 570 crore has been released. A total of Rs 3,233 crore remains pending under the mission. Ironically, the state government has spent more than the Centre’s share — nearly Rs 4,977 crore — to provide tap water connections to about 80 per cent of households.

(This article was originally published in The Federal Karnataka)