PSU, private firm employees under scanner for widespread I-T fraud in Tamil Nadu

I-T consultants, CAs, middlemen, assessees suspected to have generated bogus documents like fake donation receipts, false medical claims, fabricated rental deeds

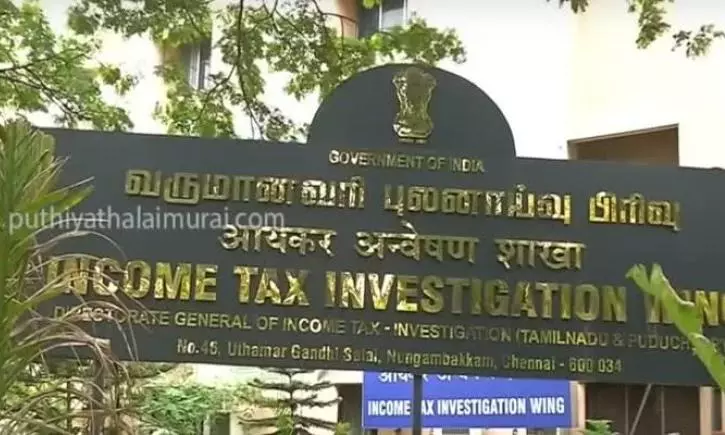

The Income Tax Department has launched an investigation in Tamil Nadu and Puducherry into some 3,000 taxpayers following the discovery of large-scale tax irregularities.

Among those under the scanner for widespread income-tax fraud are employees of public sector undertakings (PSUs) and corporates. The employees were found to be making false claims on IT returns to secure illegitimate refunds, leading to tax evasion worth crores of rupees.

The IT department's investigation wing searched multiple locations linked to income-tax consultants, chartered accountants, middlemen, and the tax assessees themselves. They are suspected to have colluded to commit tax fraud by generating bogus documents such as fake donation receipts, false medical expenditure claims, fabricated rental agreements, and incorrect claims for exempt allowances.

Also read | New Income Tax Bill to be discussed in monsoon session: Sitharaman

Employees from notable PSUs such as Bharat Heavy Electricals Ltd (BHEL), Ordnance Factory Trichy (OFT), Tamil Nadu Electricity Board (TNEB), Tamil Nadu State Transport Corporation (TNSTC), as well as those working in the Tirunelveli District Court, Heavy Alloy Penetrator Project (HAPP), TVS Global, and numerous other private entities have been implicated in income-tax fraud.

Modus operandi

One of the methods discovered was the use of edited donation receipts in the names of political parties under Section 80GGC, purportedly for deductions amounting to several lakhs of rupees.

Fraudulent claims were made under Section 80E for interest on loans for higher education, where the investigations found no legitimacy to the claims.

Tax consultants were caught preparing fictitious rent receipts and medical certificates to exploit exemptions such as HRA (house rent allowance) deduction under various sections of the IT Act, including 80C, 80DD and 80DDB. Claims went as far as stating interest on loans taken for the purchase of electric vehicles under Section 80EEB.

Also read | New tax Bill: No-deductions, low-rate regime should ease compliance

Time for corrections

Taxpayers under investigation have a window to rectify their filings by submitting revised income tax returns before the deadline of March 31, 2025. This aligns with the IT department's guidelines that allow for revised returns to be filed until the end of the relevant assessment year.

Till then, no harsh measures will be imposed on the IT assessees.

The department has also issued warnings, particularly regarding claims under Section 80GGC for donations to political parties, urging taxpayers to review their claims and maintain proper documentation to avoid further scrutiny or penalties.