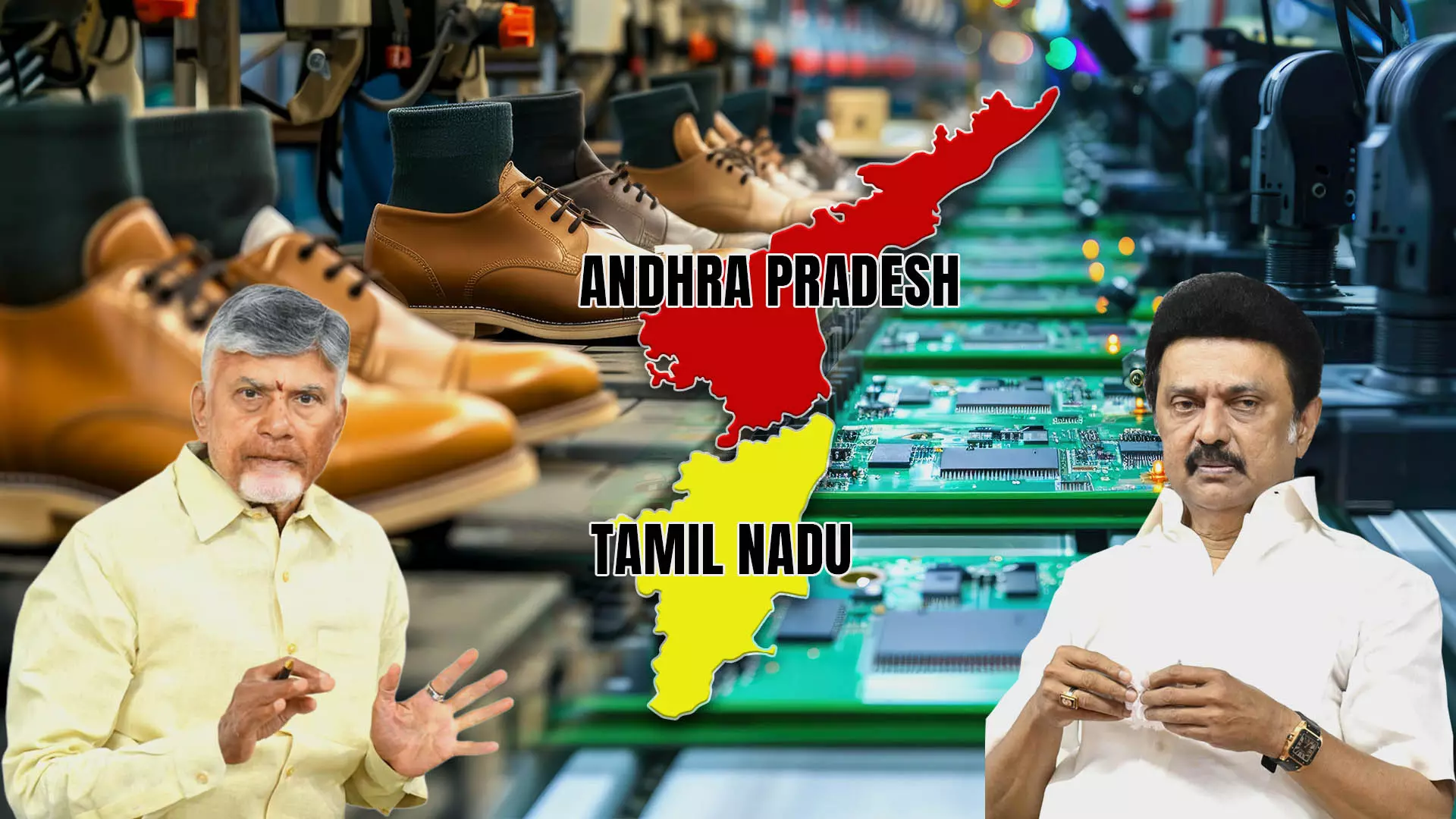

South Korean footwear manufacturer Hwaseung has moved to Andhra Pradesh

TN losing investments? Korean firm exit raises political heat

Tamil Nadu is facing tough questions after two major investments slipped away; Oppn argues that despite high-profile outreach, companies are choosing neighbouring states

Tamil Nadu’s investment climate is under the spotlight after two major companies—Foxconn and South Korea’s Hwaseung—sparked political controversy over project commitments. While the state has aggressively promoted itself as India’s leading industrial hub, the Opposition says missed opportunities point to deeper administrative lapses.

Foreign outreach and criticism

Tamil Nadu has held two Global Investors Meets in four years, with Chief Minister M.K. Stalin and Industries Minister T.R.B. Rajaa travelling across the Gulf and Europe to sign deals and pitch the state as India’s top destination.

Opposition parties, however, argue that despite high-profile outreach, companies are choosing neighbouring states. They cite this as proof of what they call “administrative apathy” and declining investor confidence.

The political attack intensified after Foxconn denied fresh investments and Hwaseung chose Andhra Pradesh over Tamil Nadu.

Hwaseung shift triggers political backlash

South Korean footwear manufacturer Hwaseung signed an MoU with Tamil Nadu in August 2025 to set up a major non-leather footwear unit in Tirunelveli, with ₹1,720 crore investment and 20,000 promised jobs.

However, the company has now shifted the same project to Kuppam in Chittoor district, Andhra Pradesh, investing ₹898 crore.

This reversal has led to sharp criticism as the Tirunelveli project was showcased as a major job creator for South Tamil Nadu.

Foxconn controversy adds pressure

The Hwaseung exit came weeks after another dispute. Foxconn’s India representative Robert Wu met CM Stalin, and Minister Rajaa announced that the company had committed ₹15,000 crore and 14,000 high-value jobs.

Foxconn later denied announcing any fresh investments, causing embarrassment for the government. Minister Rajaa clarified that discussions had been ongoing for a year and Foxconn did not categorise it as a “new” investment.

Opposition leaders from the BJP, AIADMK and PMK have accused the government of “misleading the public” and demanded a white paper on all MoUs signed in the last four years.

‘Land of missed opportunities’ claim rises

Opposition leaders say Tamil Nadu is turning into a “land of missed opportunities” ahead of the 2026 Assembly elections. They point to uneven regional industrial growth and stalled projects in the state’s southern districts.

Industry gaps in South Tamil Nadu

“Northern Tamil Nadu around Chennai, and western districts like Coimbatore and Salem have grown far better than the south,” said N. Jegathesan, President of the Tamil Nadu Chamber of Commerce.

“Except Thoothukudi, there is no large-scale industry in the remaining southern districts.”

He said the government’s industrial corridor plans had not materialised and added:

“We have repeatedly asked for balanced industrial growth. We don’t know how many industries have actually come after GIM. That’s why we demanded a white paper.”

Jegathesan also criticised the shift of multiple investors:

“Foxconn went to Gujarat, and now this Korean company has moved to Andhra Pradesh. For them, Tamil Nadu’s environment wasn’t feasible.”

Structural issues or normal market competition?

Industry bodies say that the state’s land bank and industrial corridor in the south did not effectively support large-scale projects. However, economists caution against assuming these incidents signal long-term decline.

Tamil Nadu’s core strengths

Economist K. Prabhakar argued that Tamil Nadu remains strong in electronics, software, and automobiles.

“Tamil Nadu contributes 33% of India’s manufacturing GDP, compared to the national average of 14.5%,” he said.

On Andhra Pradesh’s aggressive push, he noted:

“Chandrababu Naidu offers very attractive incentives and cheaper land. Kuppam is close to Chennai, so companies can export easily. But Tamil Nadu has scarce land, so matching those incentives is difficult.”

Prabhakar added that Tamil Nadu’s higher wages and refusal to allow 12-hour shifts also influence decisions:

“We cannot reduce wage rates. But Tamil Nadu has long-term advantages—educated workforce, stable administration, strong industrial base.”

He rejected the narrative that Tamil Nadu is losing out:

“Thinking it is a land of missed opportunities is not true. It remains a land of opportunities with 11.9% economic growth, the highest in India.”

Are these political accusations or genuine investment shifts?

Economist Venkatesh Athreya said states have limited resources and must strike a balance:

“It is possible the government made its decision on sound economic considerations. We cannot simply say a project left because of incompetence.”

He added that employment outcomes are not solely dependent on foreign direct investment:

“FDI projects contribute, but they cannot solve Tamil Nadu’s entire unemployment challenge.”

Athreya said that without full information on the government’s assessment, blaming the administration may be premature:

“Accusations of incompetence or corruption cannot replace economic reasoning.”

What really happened with Hwaseung?

Officials in the Tamil Nadu Planning Commission told The Federal that Hwaseung insisted on prime land in Tirunelveli.

The state’s cost–benefit analysis did not justify allocating such land, they said.

They also pointed out that another major non-leather footwear company successfully began operations in Ariyalur in 2023, indicating that Tamil Nadu continues to attract similar investments. However, Hwaseung refused to shift from its preferred location.

What lies ahead?

As Tamil Nadu heads into the 2026 Assembly elections, these back-to-back episodes will shape both political narratives and investor perceptions.

Whether these are isolated business decisions or early signs of a shift in the state’s industrial momentum is a question industry and political observers will closely watch in the coming months.

The content above has been transcribed from video using a fine-tuned AI model. To ensure accuracy, quality, and editorial integrity, we employ a Human-In-The-Loop (HITL) process. While AI assists in creating the initial draft, our experienced editorial team carefully reviews, edits, and refines the content before publication. At The Federal, we combine the efficiency of AI with the expertise of human editors to deliver reliable and insightful journalism.