Plan to prepay your home loan? Here's why it may not be wise

Shruti took a home loan under a fixed interest rate some five years back. While taking the loan, she had calculated her repaying capacity based on her emoluments at that time. But over the years, she has grown in her career, resulting in substantially increased income. Now, she can pay bigger instalments and opt to clear the loan early. However, she is insulated from increases in the floating interest rates for home loan since she took the loan under a fixed rate. So, would it be worthwhile for her to increase the instalment and clear the loan early?

Before we answer that question, let us study another scenario. Shankar took a home loan under a floating rate of interest, which is linked to the repo rate. Since May 22, 2020, the repo rate has constantly gone upwards, increasing by 2.50 per cent. Obviously, Shankar’s EMIs have also increased correspondingly. Now, he has the option to either increase the instalment amount or extend the loan period. Since, like Shruti, his salary has also gone up during this period, he can afford to increase the instalment amount. But should he opt to increase the instalment amount? Or, would it be better to extend the loan tenure?

Many people taking home loans face this predicament. A home loan is generally for a long term of 15 or 20 years, and many salaried-class people take one at the beginning of their career. They get a good hike in salary in the initial years, enabling them to have surplus cash over the years. At one point, many of them face this question: Should they clear the loan early or use the surplus funds for other investments?

Also read: Should you book profit without dividend, or book loss after getting dividend?

Factors to consider

The most important factor to consider is the cost of servicing the loan vis-à-vis the income that can be earned from investments. For example, if the borrower can increase the home loan EMI by, say, Rs 10,000 for another 10 years, s/he must first calculate the possible return on the saving and compare with the saving of interest on home loan due to such prepayment.

This calculation will also depend on the type of interest on the home loan. If it is a fixed rate, the interest that can be saved by excess repayment can be measured easily. If it is a floating rate, a future interest rate must be assumed for such calculation.

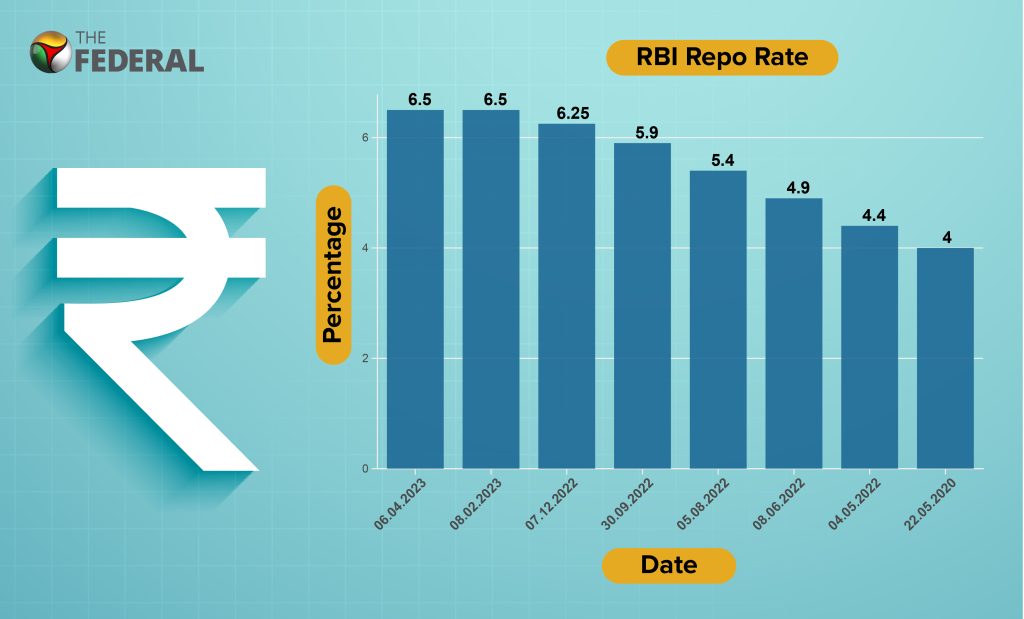

In October 2019, all banks made the transition to external benchmarks for pricing new home loans. Most banks have picked the RBI repo rate as the external benchmark. The repo rate has undergone changes as follows:

In all probability, the repo rate will go up further in the near term, as banks all over the world are fighting inflation, and the repo is used as a tool to fight inflation.

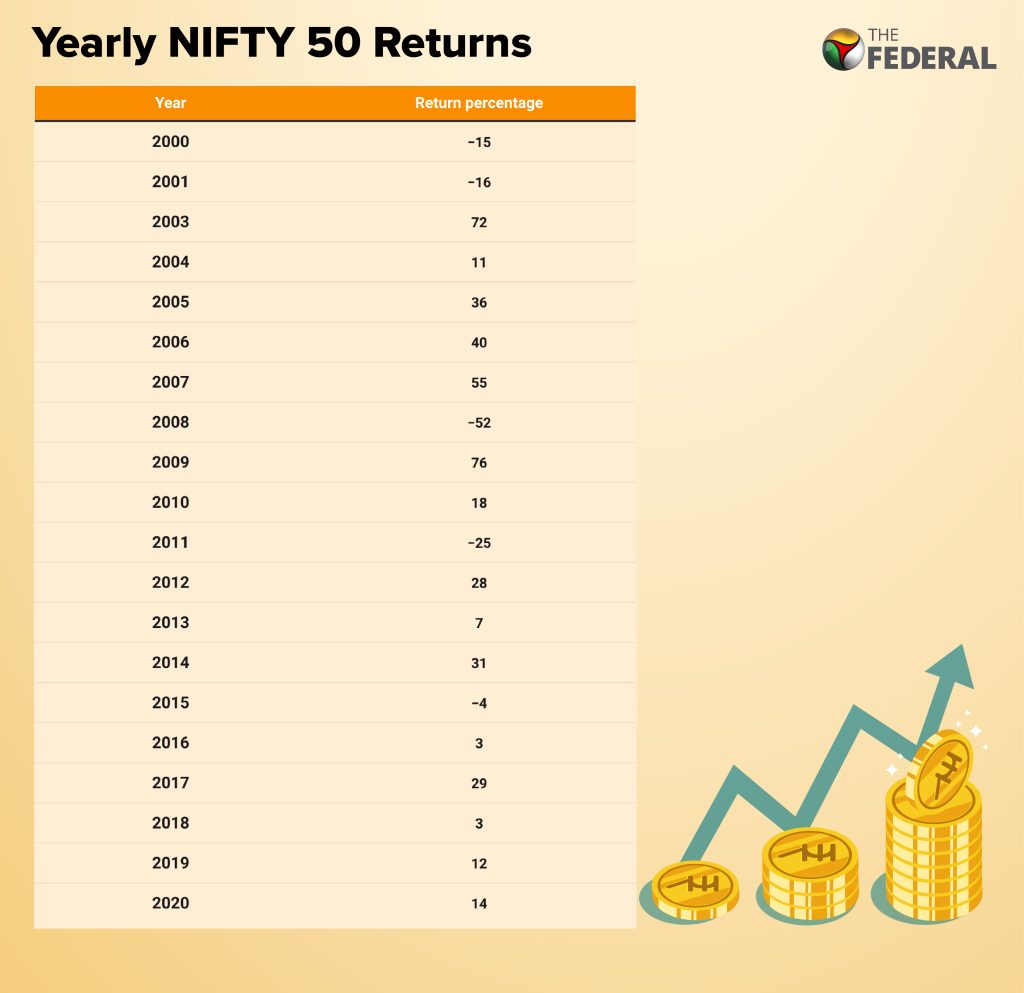

The next step is to estimate the return from investments. Since the housing loan is a long-term borrowing, cash flow saved by fewer instalments can also be deployed in the long term. Equity investment provides better return in the long term.

Also read: Akshaya Tritiya: Why buying jewellery is not the same as investing in gold

The following table provides NIFTY 50 returns over the past 20 years. We can notice that barring five years, it has always given a positive return. The positive return ranges from 3.01 to 75.76 per cent. In the long term, equity will provide better return than the interest saved from home loan prepayment.

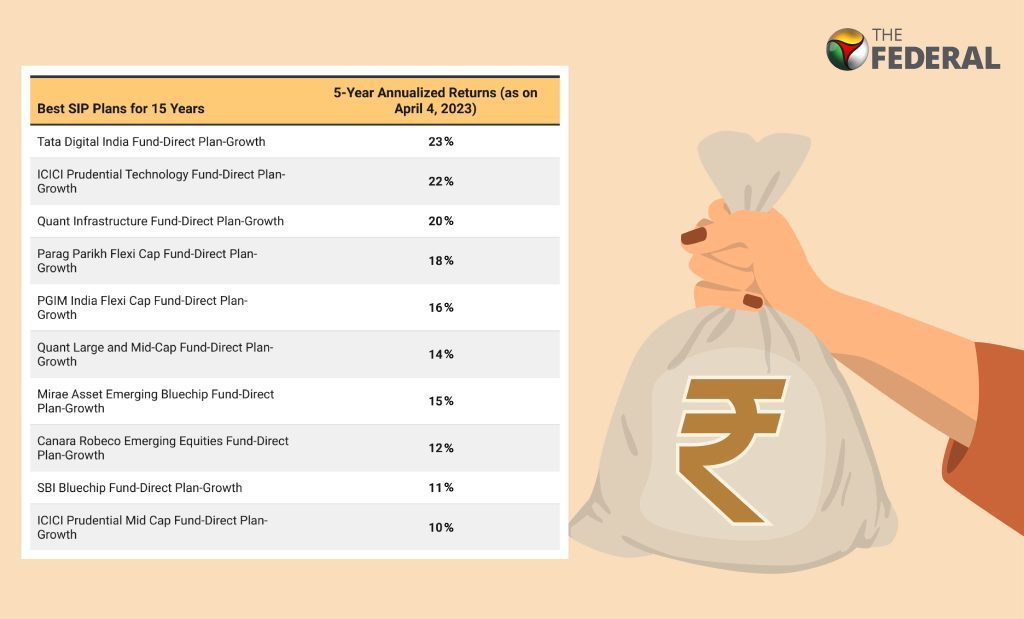

Those who are not comfortable with direct equity can choose equity mutual fund schemes under the SIP route. The following table provides five-year annualized returns on some SIP plans for 15 years. Please remember that past performance does not provide any assurance about future performance.

I-T under old or new regime

Under the old income tax regime, people are eligible to claim interest paid on housing loans and instalments under deductions. Hence, one must consider the amount that can be saved by such exemptions and deductions if s/he wants to continue under the old IT regime.

Link between interest/income and inflation

When inflation goes up, interest rates may also go up. Based on inflation, return from equity investment may also go up, as companies generally have the pricing power to pass on the cost. Hence, when interest rates on housing loans go up, the return from investment may also go up.

Also read: Tax debate: Does a housing loan amount to savings?

Exceptions

In most cases, prepaying the housing loan may not be advantageous. However, each borrower must work out her/his individual case. But there are some situations where closing the home loan early may be required.

If you intend to sell the house soon, it is better to close the loan account early. That will make the property unencumbered, which will facilitate easy sale. Similarly, if you want to offer the property as security for some other borrowing, it would be better to keep it unencumbered.

(The writer is a retired banker. The views expressed here are his own, and do not constitute investment advice.)