States wary as 16th Finance Commission report heads to Parliament

With no terms of reference and a fraught legacy, the Commission's award may reignite Centre-state tensions over tax devolution and fiscal fairness

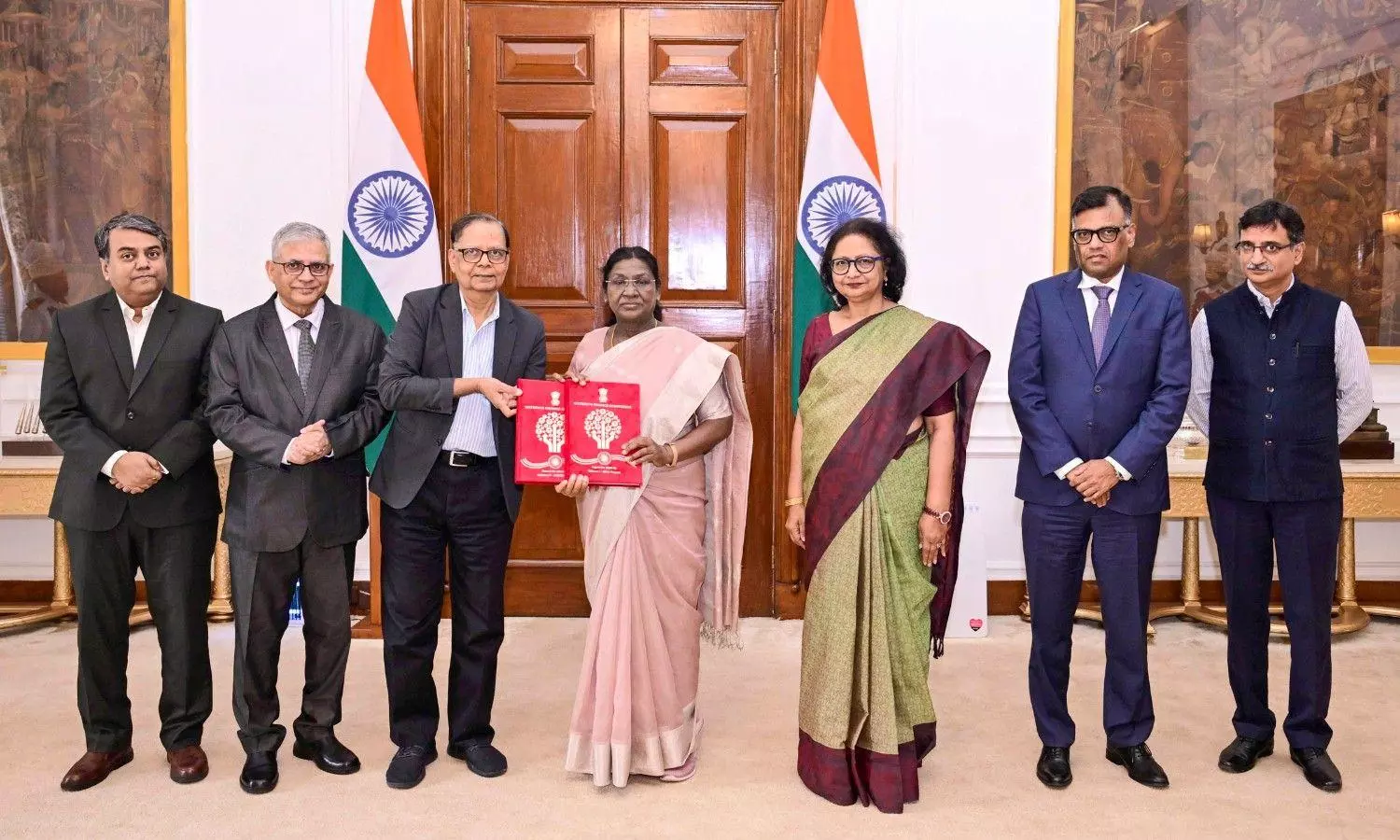

The 16th Finance Commission (FC) has submitted its report to the President of India, it will be tabled in next month’s Parliament session. What it holds for states and how states react to those will be clear then but there are reasons to be circumspect.

The recent history of tax devolution has not been very encouraging. In fact, states, particularly those ruled by Opposition parties, have grown wary of “cooperative federalism” invoked to assure them of the Centre’s good intentions in fiscal devolution, while their experience has been quite the contrary.

No, it didn’t begin with the introduction of GST in 2017, but goes all the way to the 14th FC, which made history by raising the tax devolution from 32 per cent (13th Finance Commission) to 42 per cent at one go in its report of December 2014.

Deceptive beginning

Just before accepting the 14th FC’s historic award, Prime Minister Narendra Modi had addressed chief ministers at the first Governing Council of NITI Aayog, on February 8, 2015, asking them to “forge a model of cooperative federalism”, in the spirit of “cooperative, competitive federalism” to chart “a common course to progress and prosperity”.

Also read | Digital push under NEP sparks concerns on funding, access and autonomy

Days later, on February 24, he wrote to all chief ministers announcing that his government had “wholeheartedly accepted” the 14th FC’s award “although it puts a tremendous strain on the Centre’s finances”.

This was not true. The Centre had tried to scuttle the higher tax devolution. None other than the 14th FC report spilled the beans first.

In its December 2014 report, it said the Finance Ministry had, in its “memorandum to us in September 2014” (after the NDA government took over) argued against higher tax devolution. The Centre sought a far greater fiscal space for itself on the plea that it needed more funds “for its development agenda”, “increasing demands” on its resources for “defence, internal security and energy security”, “obligation to ensure welfare programmes” etc.

Grounds for dismissal

The Commission dismissed these on four grounds:

(i) States not being entitled to the growing share of cess and surcharges in the revenues of the Union government

(ii) The importance of increasing the share of tax devolution in total transfers

(iii) An aggregate view of the revenue expenditure needs of states without Plan and non-Plan distinction

(iv) The space available with the Union Government.

The next revelation came on July 3, 2023. Speaking at a seminar in New Delhi, BVR Subrahmanyam, then joint secretary in the Prime Minister’s Office (PMO) and now CEO of NITI Aayog, disclosed that he was deputed to influence the Commission’s decision, which failed.

Subrahmanyam said then Finance Commission Chairman YV Reddy told him: “Brother, go and tell your boss he has no choice”.

Cess and surcharge

Having failed to scuttle it and having taken undue credit, the Centre dramatically expanded cess and surcharge — not in part of the divisible pool of tax and not shared with states — to fill its coffers.

Also read | GST 2.0 and disaster relief: A fiscal reform missing the resilience link

As a result, cess and surcharge collections boomed from 13.14 per cent of its gross tax revenue in FY14 (14th FC data) to 20.5 per cent in FY21 (Rajya Sabha answer of July 29, 2025), before it was rolled down gradually to 14 per cent in FY25 (RE) and 13.8 per cent in FY26 (BE) because of states’ pressure.

What to expect from 16th FC?

The 15th FC brought down the tax devolution to 41 per cent, pointing at the Centre’s need for extra resources as Jammu and Kashmir were downgraded to two Union Territories (Jammu and Kashmir and Ladakh). The status of these UTs remains unchanged – and possibly, the award may remain unchanged.

Also read | How Centre flouted GST law, diverted ₹3.1 lakh crore meant for states

However, how the 16th FC addresses a few key concerns of states would be keenly awaited:

♦ Actual tax devolutions to states average 31.8 per cent during the 15th FC period of FY21-FY25 (RE), against the award of 41 per cent

♦ Total transfers (including grants and central scheme funds) average 35.9 per cent during FY21-FY25 (RE), against “around 50 per cent” during FY11-FY13 (14th FC)

♦ States contributing more to the Centre’s tax kitty receive less, and vice versa

State GST has failed to generate as much revenue as the indirect taxes subsumed in it did for all states except Maharashtra, forcing states to demand resumption of GST compensation. GST 2.0 has reinforced the demand and the GST Council is reportedly considering setting up a GoM to address this.

There is more.

ToR-less 16th FC

The 16th FC doesn’t have terms of reference, or ToR. It merely has a three-point task, set out by the Union Cabinet while approving it on November 29, 2023: recommend tax devolution and allocations to individual states, principles to govern grants, and measures to augment states’ funds to devolve more to local bodies.

Initially, the Union Cabinet had said the ToR “will be notified in due course of time” but two days later, on December 1, 2023, then Finance Secretary TV Somanathan (now cabinet secretary) ruled it out saying, “there is nothing more to come”.

This may be because the 15th FC’s ToR had three entries that sparked strong protests:

1) To keep in mind “the impact on the fiscal situation of the Union government” due to higher tax devolution

2) Use population data of 2011 for tax devolution (not that of 1971 Census as was the practice until then)

3) Spell out “conditions” that may be imposed on states for any borrowing (as against the FRBM limit of 3 per cent of GSDP without conditions).

Also read | The Nehru Development Model review: Panagariya indicts a ‘flawed’ economic legacy

Thus, it is for Arvind Panagriya, chairman of 16th FC, and his team to decide what factors to consider in recommending awards — including on the population base (1971 or 2011 Census). Using the 2011 Census would mean states with higher population will get more funds, against those which have better managed their population growth, like the southern states.