Live | RBI cuts repo rate for first time in 5 years

It had last reduced the repo rate by 40 basis points to 4 per cent in May 2020; RBI projects inflation for FY25 at 4.8 pc, FY26 projection at 4.2 pc

The Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) on Friday (February 7) reduced the repo rate by 25 basis points to 6.25 per cent.

Also read: RBI: Focus shifts to growth-driven rate cut under new Governor after status quo year

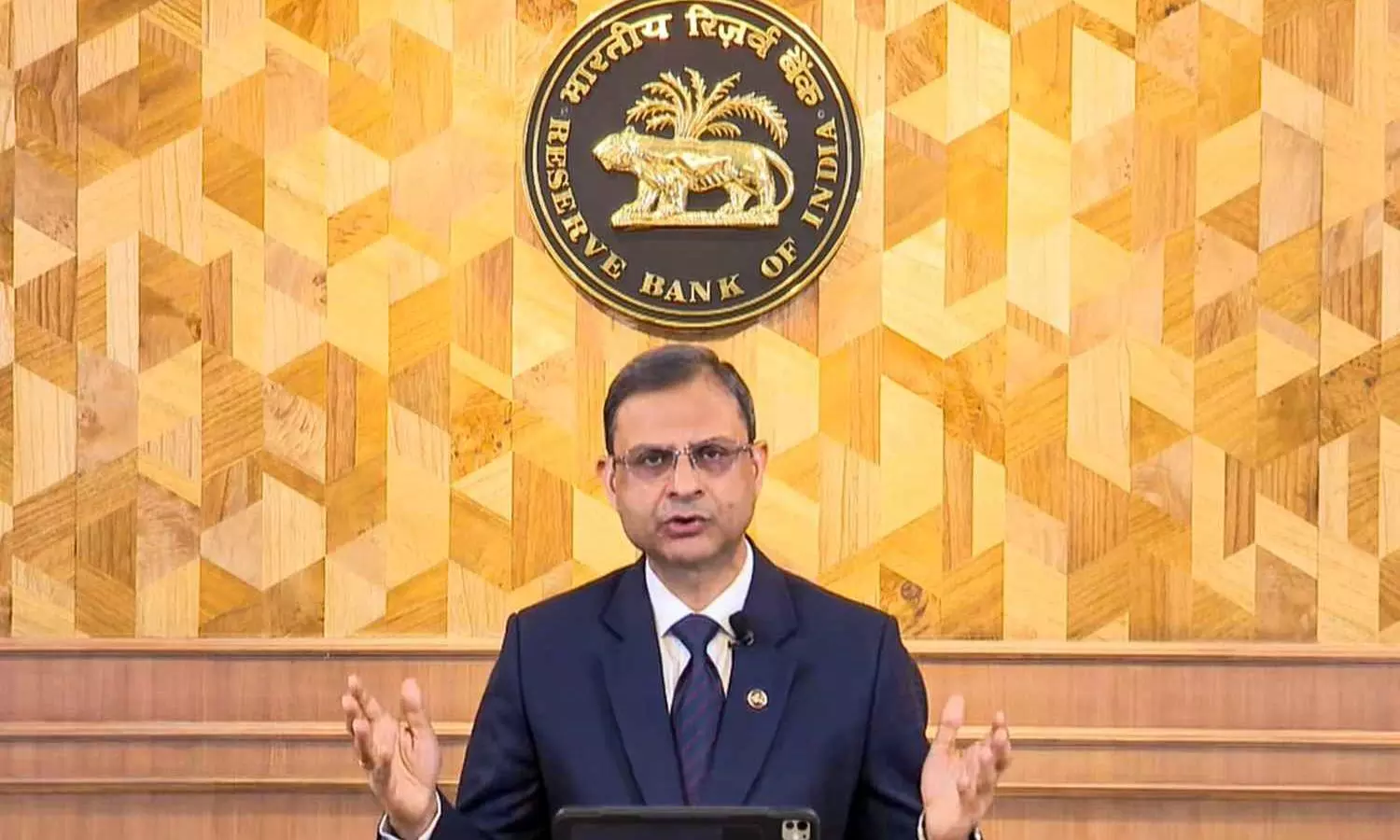

New RBI Governor Sanjay Malhotra, who chaired his first MPC meeting, announced the decision of the six-member panel on Friday morning. The reduction in interest rate has come after a gap of nearly five years.

Interest rate cut after Budget

The Monetary Policy Committee unanimously decided to slash policy rate by 25 basis points to 6.25 per cent, Malhotra said.

The repo rate was kept unchanged for 11 monetary policy meetings in a row.

Also read: Rupee's fall all due to dollar's rise, RBI intervention can harm exports: Rajan

The interest rate cut comes within a week of Finance Minister Nirmala Sitharaman in Budget 2025-26 providing biggest ever tax break to the middle class to boost consumption after the economy has slowed to its lowest pace since the pandemic.

Previous rate cut in 2020

The RBI had last reduced the repo rate by 40 basis points to 4 per cent in May 2020 to help the economy tide over the crisis following the outbreak of the Covid pandemic and subsequent lockdown.

But in May 2022 the central bank started a rate hike cycle in view of the Russia-Ukraine war and paused it only in May 2023.

The three-day meeting of the MPC started on Wednesday.

Live Updates

- 7 Feb 2025 1:33 PM IST

Repo rate cut to provide long-awaited relief on interest rates: Experts

The repo rate cut by 25 basis points by the monetary policy committee (MPC) of RBI announced Friday will give a long-awaited relief on interest rates and also be supportive of economic growth, according to experts.

Repo rate is the interest rate at which the RBI lends money to commercial banks.

Chief economist of Crisil Limited Dharmakirti Joshi said that as expected, the MPC of the central bank cut rates for the first time since May 2020.

The repo rate has been cut by 25 basis points which now stands at 6.25 per cent.

Joshi said that the recent easing in consumer price index (CPI) inflation and the need to remain supportive of economic growth has moved the RBI to act in this regard.

However, the MPC maintained the policy stance at 'neutral', which gives flexibility to remain data dependent and respond to exigencies, Joshi said.

The MPC moves in the future will depend more on domestic inflation, he said.

"Elevated rates have impacted India's GDP growth, while the budget for the next financial year is mildly supportive of growth, while continuing on the path of fiscal consolidation," he said.

Joshi expressed hope that the MPC would cut the repo rate to another 75 basis points to 100 basis points in the next financial year.

Chief Investment Officer of Axis Securities PMS Naveen Kulkarni said, "The RBI reversed the interest rate cycle by announcing a rate cut of 25 basis points. This was largely anticipated." The GDP growth for the current fiscal has been revised downwards to 6.4 per cent from 6.6 per cent, he said.

"And for the next fiscal, the GDP is expected to be at 6.7 per cent. We could see another rate cut of 25 basis points in the forthcoming meetings of the MPC," he said.