Live | RBI cuts repo rate for first time in 5 years

It had last reduced the repo rate by 40 basis points to 4 per cent in May 2020; RBI projects inflation for FY25 at 4.8 pc, FY26 projection at 4.2 pc

The Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) on Friday (February 7) reduced the repo rate by 25 basis points to 6.25 per cent.

Also read: RBI: Focus shifts to growth-driven rate cut under new Governor after status quo year

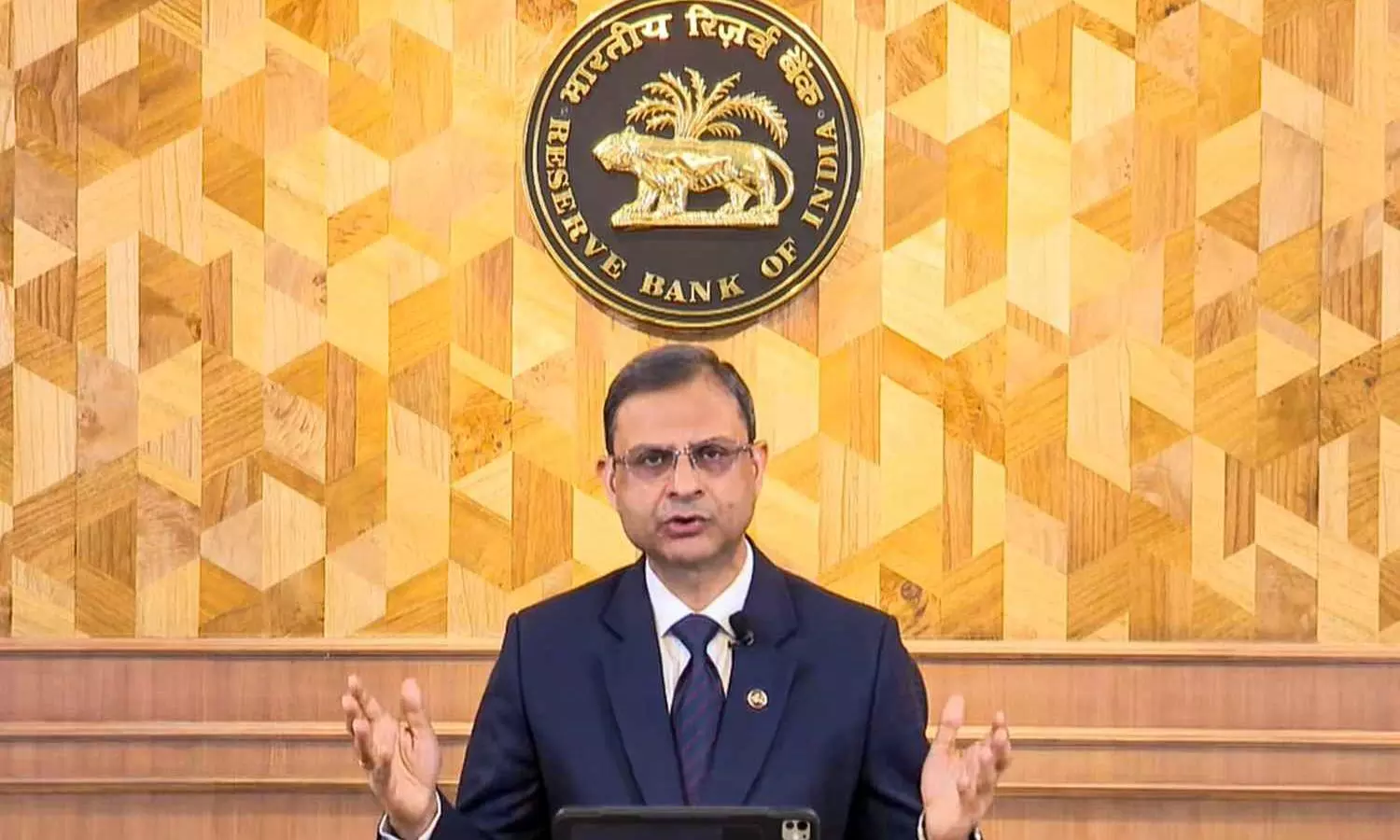

New RBI Governor Sanjay Malhotra, who chaired his first MPC meeting, announced the decision of the six-member panel on Friday morning. The reduction in interest rate has come after a gap of nearly five years.

Interest rate cut after Budget

The Monetary Policy Committee unanimously decided to slash policy rate by 25 basis points to 6.25 per cent, Malhotra said.

The repo rate was kept unchanged for 11 monetary policy meetings in a row.

Also read: Rupee's fall all due to dollar's rise, RBI intervention can harm exports: Rajan

The interest rate cut comes within a week of Finance Minister Nirmala Sitharaman in Budget 2025-26 providing biggest ever tax break to the middle class to boost consumption after the economy has slowed to its lowest pace since the pandemic.

Previous rate cut in 2020

The RBI had last reduced the repo rate by 40 basis points to 4 per cent in May 2020 to help the economy tide over the crisis following the outbreak of the Covid pandemic and subsequent lockdown.

But in May 2022 the central bank started a rate hike cycle in view of the Russia-Ukraine war and paused it only in May 2023.

The three-day meeting of the MPC started on Wednesday.

Live Updates

- 7 Feb 2025 11:56 AM IST

Markets trade higher after rate cut

Benchmark indices Sensex and Nifty were trading in the positive territory on Friday. The 30-share BSE benchmark Sensex traded 233.96 points higher at 78,290.08 in the late morning trade. The NSE Nifty quoted 83.40 points up at 23,686.75.

- 7 Feb 2025 11:47 AM IST

Rate cut may have 'limited direct impact': CREDAI

Realtors' apex body CREDAI on Friday said the RBI's decision to cut benchmark lending rate by 25 basis points might have "limited direct impact" and sought further reduction in the next monetary policy meet for "stronger impetus" to housing demand.

Reduction in repo rate may lead to lowering of interest rates on home loans provided banks decide to pass on the benefits.

Commenting on the monetary policy announcement, CREDAI National President Boman Irani said, "The RBI's decision to reduce repo rate by 25 basis points to 6.25 per cent supplements recent announcements in the Budget aimed at boosting spending and spur economic growth." This supportive monetary policy was "imperative", especially after the recent 50 basis points reduction in Cash Reserve Ratio (CRR), which has already injected significant liquidity into the banking system, he added.

"While the current cut may have a limited direct impact, we anticipate that a further rate cut in the next MPC meeting will provide stronger impetus to overall demand, accelerating housing sales, particularly in the mid-income and affordable segments," Irani observed.

- 7 Feb 2025 10:40 AM IST

Summary of Monetary Policy Statement, 2024-25

Resolution of the Monetary Policy Committee (MPC)

The MPC held its 53rd meeting from 5-7 February 2025, chaired by Shri Sanjay Malhotra, Governor, Reserve Bank of India.

Other members present included Dr. Nagesh Kumar, Shri Saugata Bhattacharya, Prof. Ram Singh, Dr. Rajiv Ranjan, and Shri M. Rajeshwar Rao.

Monetary policy decisions

The policy repo rate was reduced by 25 basis points to 6.25% with immediate effect.

The standing deposit facility (SDF) rate was adjusted to 6.00%, while the marginal standing facility (MSF) rate and Bank Rate were set at 6.50%.

The committee will continue with a neutral monetary policy stance, prioritising inflation control while supporting growth.

These decisions align with the medium-term target of 4% consumer price index (CPI) inflation, within a ±2% band.

Growth and inflation outlook

Global economy: Growth remains below historical averages amid slow disinflation, geopolitical tensions, and policy uncertainties.

Domestic economy:

GDP growth for 2024-25 is estimated at 6.4% due to a recovery in private consumption.

The services and agriculture sectors are supporting growth, while industrial growth remains weak.

GDP growth for 2025-26 is projected at 6.7%, with quarterly estimates:

Q1: 6.7%

Q2: 7.0%

Q3: 6.5%

Q4: 6.5%

Inflation trends:

Headline inflation moderated from 6.2% in October 2024 to lower levels in November-December due to falling vegetable prices.

Core inflation remains low, while fuel prices remain in deflation.

CPI inflation for 2024-25 is projected at 4.8%, with Q4 at 4.4%.

CPI inflation for 2025-26 is expected to be 4.2%, assuming normal monsoons:

Q1: 4.5%

Q2: 4.0%

Q3: 3.8%

Q4: 4.2%

Rationale for monetary policy decisions

Inflation outlook is improving and is expected to gradually align with the 4% target.

Economic growth remains below last year's levels, creating room for policy support.

External risks (financial market volatility, trade uncertainties, and weather disruptions) necessitate continued vigilance.

The MPC will maintain a neutral stance to ensure flexibility in responding to economic changes.

Next steps

The minutes of the meeting will be published on 21 February 2025.

The next MPC meeting is scheduled for 7-9 April 2025.

- 7 Feb 2025 10:34 AM IST

CPI inflation for FY25 projected at 4.8 pc

RBI Governor Sanjay Malhotra said CPI (Consumer Price Index) inflation for FY25 is projected at 4.8 per cent.

Early corporate results for the third quarter ended December 2024 indicate a mild recovery in the manufacturing sector, he said, adding that business expectations remain upbeat and services continue remain good.

While rural demand is trending upwards, urban demand is mixed, he said.

Core inflation is expected to rise but remain moderate.

- 7 Feb 2025 10:32 AM IST

RBI projects India's GDP growth at 6.7 pc next fiscal

Sanjay Malhotra said the RBI projects India's growth for FY26 at 6.7 per cent. The real GDP growth for FY26 is projected at 6.75 per cent. For Q1, it is at 6.7 per cent, Q2 - 7 per cent, Q3 and Q4 - 6.5 per cent each.

The GDP growth projection is keenly watched following the slowdown in the economy. It had resulted in a sluggish second quarter of FY25 and lower first advanced estimates.

The Economic Survey 2025 estimated a real GDP growth of 6.4 per cent in FY25, 20 bps lower than the projection by the RBI in its December monetary policy.