Live | RBI cuts repo rate for first time in 5 years

It had last reduced the repo rate by 40 basis points to 4 per cent in May 2020; RBI projects inflation for FY25 at 4.8 pc, FY26 projection at 4.2 pc

The Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) on Friday (February 7) reduced the repo rate by 25 basis points to 6.25 per cent.

Also read: RBI: Focus shifts to growth-driven rate cut under new Governor after status quo year

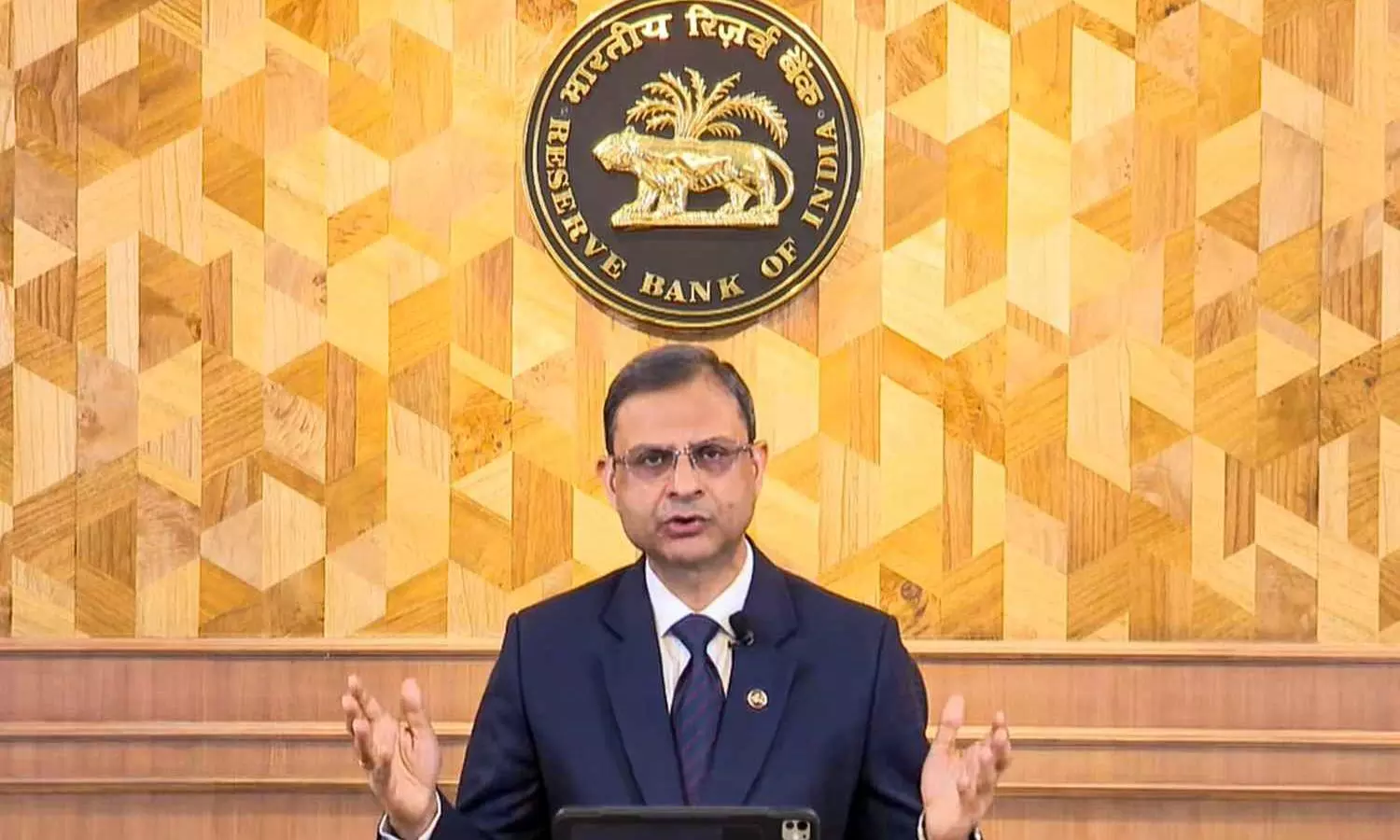

New RBI Governor Sanjay Malhotra, who chaired his first MPC meeting, announced the decision of the six-member panel on Friday morning. The reduction in interest rate has come after a gap of nearly five years.

Interest rate cut after Budget

The Monetary Policy Committee unanimously decided to slash policy rate by 25 basis points to 6.25 per cent, Malhotra said.

The repo rate was kept unchanged for 11 monetary policy meetings in a row.

Also read: Rupee's fall all due to dollar's rise, RBI intervention can harm exports: Rajan

The interest rate cut comes within a week of Finance Minister Nirmala Sitharaman in Budget 2025-26 providing biggest ever tax break to the middle class to boost consumption after the economy has slowed to its lowest pace since the pandemic.

Previous rate cut in 2020

The RBI had last reduced the repo rate by 40 basis points to 4 per cent in May 2020 to help the economy tide over the crisis following the outbreak of the Covid pandemic and subsequent lockdown.

But in May 2022 the central bank started a rate hike cycle in view of the Russia-Ukraine war and paused it only in May 2023.

The three-day meeting of the MPC started on Wednesday.

Live Updates

- 7 Feb 2025 10:29 AM IST

Drainage of liquidity attributed to advance tax payments: RBI Governor

The RBI Governor said the drainage of liquidity is attributed to advance tax payments.

RBI believes in market efficiencies, does not target any exchange rate or band. It is determined by market forces, he said.

- 7 Feb 2025 10:26 AM IST

Forex policy has remained consistent: RBI Governor

The RBI Governor said the forex policy has remained consistent, in favour of orderly and stable market operation, and does not target any exchange rate.

- 7 Feb 2025 10:25 AM IST

Cyber fraud getting more sophisticated: RBI Governor

The RBI Governor said cyber frauds are getting more sophisticated, and the central bank is taking measures to rein it in. He urged financial institutions to implement robust security processes.

- 7 Feb 2025 10:23 AM IST

CAD expected to remain within sustainable level this year: RBI Governor

Sanjay Malhotra said the current account deficit (CAD) is expected to remain within sustainable level this year.

The RBI raised India’s FY26 growth aim to 6.7% from 6.6%.

- 7 Feb 2025 10:19 AM IST

Neutral stance, fully focused on a durable alignment: RBI Governor

The RBI Governor said the central bank's neutral stance is unambiguously focused on a durable alignment of inflation with the target while supporting economic growth.

- 7 Feb 2025 10:18 AM IST

Food inflation has improved: RBI

"Inflation has declined supported by favourable outlook on food. It is expected to moderate further gradually aligning with the target," said Malhotra.

- 7 Feb 2025 10:16 AM IST

Sequential moderation in inflation: RBI Governor

The RBI Governor said there has been a moderation in inflation in November and December 2024.

- 7 Feb 2025 10:15 AM IST

There is a tradeoff between stability and efficiency RBI Governor Sanjay Malhotra

RBI Governor Sanjay Malhotra said there is a tradeoff between stability and efficiency in the economy. "The interest of economy demands financial stability," he said, adding: "We will continue to strengthen and rationalise the prudential framework."

"We will continue with the consultative process in the regulation making process. We want to reassure all stakeholders that we will continue with the consultative process."